The key areas of law in which I work are cross-border contract law, compliance with international business legislation, legal support for IT companies, and legal protection of businesses in different countries.

Initial Context:

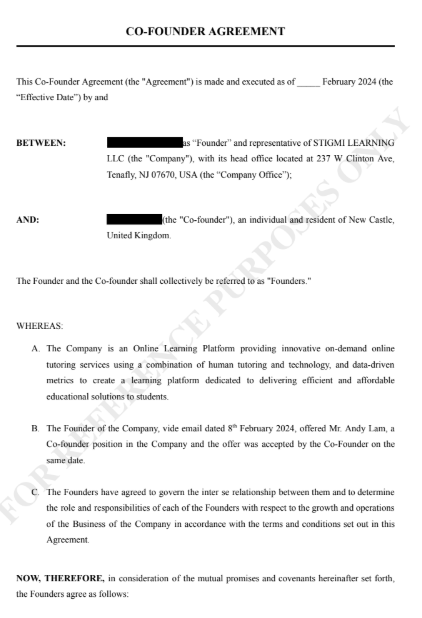

Two co-founders of an online education startup approached me. The company specializes in personalized tutoring via a digital platform. One acted as the primary investor, contributing $20,000 to the business, while the other was the technical co-founder, offering his time, skills, and code as sweat equity.

The parties aimed to create a legally binding agreement that would clearly define the terms of partnership, intellectual property rights, obligations, decision-making mechanisms, and exit scenarios.

However, the situation was complicated by several critical factors:

- Complex equity structure: it was necessary to properly allocate equity, considering asymmetric contributions—financial from one partner and technical from the other.

- Legal risks: mechanisms were needed to protect against data leakage, competition, and disputes over code and IP ownership.

- Unequal positions: one party contributed significant capital, while the other only committed to future technical delivery, potentially upsetting the balance of interests.

- Lack of defined roles and exit scenarios: which was critical for an early-stage startup, especially in a volatile market.

The Solution:

I developed a comprehensive Founders Agreement to ensure legal stability, protect the investor’s interests, and motivate the technical co-founder. Key components included:

🔹 Asymmetric equity with vesting schedule:

I allocated 27.5% equity to the technical co-founder with a 1-year cliff (no vesting if they exit early) and a 4-year vesting schedule. This protects the founder’s investment, encourages long-term commitment, and ties equity to actual contribution.

🔹 Decision-making hierarchy:

All major business decisions remain with the Founder, while the Co-founder has veto rights for technical implementation. This avoids deadlocks in critical matters while maintaining balance.

🔹 Balanced IP ownership:

All pre-existing IP (code, algorithms, designs) remains the property of each founder. However, all new work created during company operations automatically belongs to the company, with no right to reuse in outside projects.

🔹 Legal protection mechanisms:

I included clauses on confidentiality, non-compete for 2 years, non-disparagement, and penalty mechanisms for violations, including automatic loss of unvested equity or damage compensation.

🔹 Exit structure:

Various exit scenarios were provided—voluntary, forced, or mutual. Each included fair market valuation of equity with buyout rights by the company or partner.

🔹 Operational clarity:

Roles were defined: Founder manages finance, marketing, and strategy; Co-founder handles tech development, support, and product growth. Provisions allow reallocation of responsibilities as the team evolves or expands.

The Result:

The agreement I created became the legal foundation for the partnership. It not only protected the investor’s capital but also motivated the technical Co-founder to remain committed for at least 4 years.

Key achievements:

- Balanced both parties’ interests despite unequal contributions.

- Established a clear decision-making process to respond quickly to challenges.

- Defined transparent exit and equity transfer rules to avoid future legal confusion.

- Prevented IP from being transferred to external projects—ensuring full company control.

This case shows how a well-structured legal agreement between founders can protect a startup from internal conflicts, financial loss, and IP disputes. The key innovation was that I balanced unequal contributions with asymmetric voting rights and equity terms, while still respecting the principles of partnership. As a result, the collaboration started on fair, effective, and legally secure terms.