Senior corporate and company lawyer with extensive international experience across the Gulf, London, New York and APAC. Background includes Partnership at a Top 10 Global Elite law firm as well as offshore law firm, and serving as Head of Legal and shadow Board Secretary at a Gulf sovereign wealth fund. Skilled in M&A, corporate governance, joint ventures, complex cross-border transactions, disputes strategy, and leadership of legal teams. Proven ability to advise C-suite and boards, manage legal operations globally, and deliver measurable value through restructuring, compliance frameworks, and high-value deal execution.

Use of Bank Loans in Private Transactions: A Comprehensive Approach to Investment Management

Case Context

In the field of private equity, sponsors often face the need for quick and reliable financing to acquire or develop a target company. One of the most effective tools in this case remains bank loans, as they provide significant amounts at relatively low interest rates.

Under modern securities regulation, sponsors must not only understand financial mechanisms but also combine them with competent investment advisory, financial planning services, and financial consulting to maintain control over the company.

Key Challenges

The main challenge lies in balancing:

- the speed of financing,

- control over the target company,

- minimizing financial and operational risks.

- Strict loan conditions may include:

- restrictions on capital use,

- financial covenants (e.g., debt-to-EBITDA ratio),

- high penalties for violating loan terms.

At the same time, sponsors need to develop investment strategies and portfolio management approaches that allow obtaining necessary funds without losing management flexibility.

Solutions and Analysis Steps

- Using Bank Loans as the Primary Source of Financing

- Assessment of bank credit lines and conditions: interest rates, repayment terms, collateral.

- Selection of the bank with conditions best adapted to the specifics of the transaction.

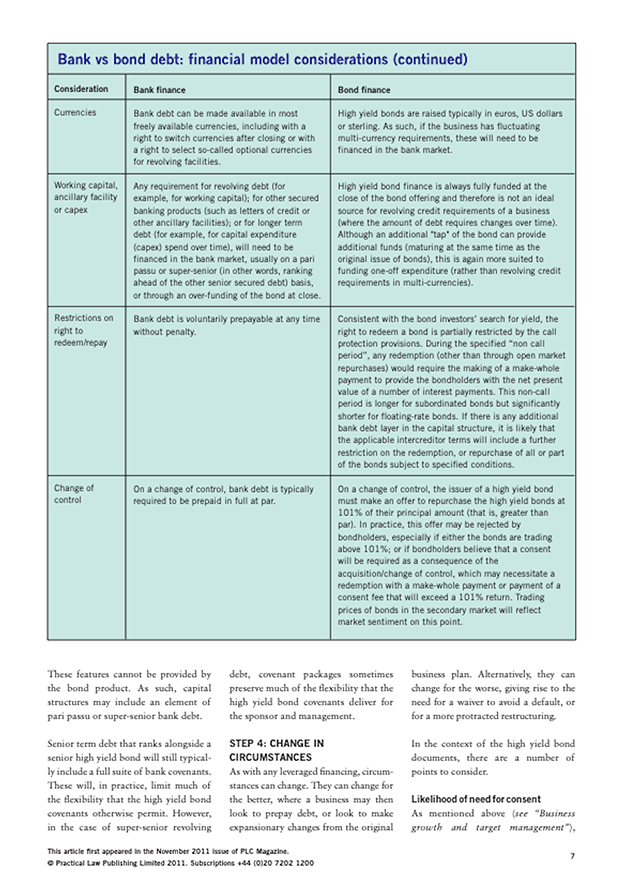

- Analysis of Financial and Operational Restrictions

- Verification of imposed financial covenants.

- Determination of the possibility to make additional investments or refinancing.

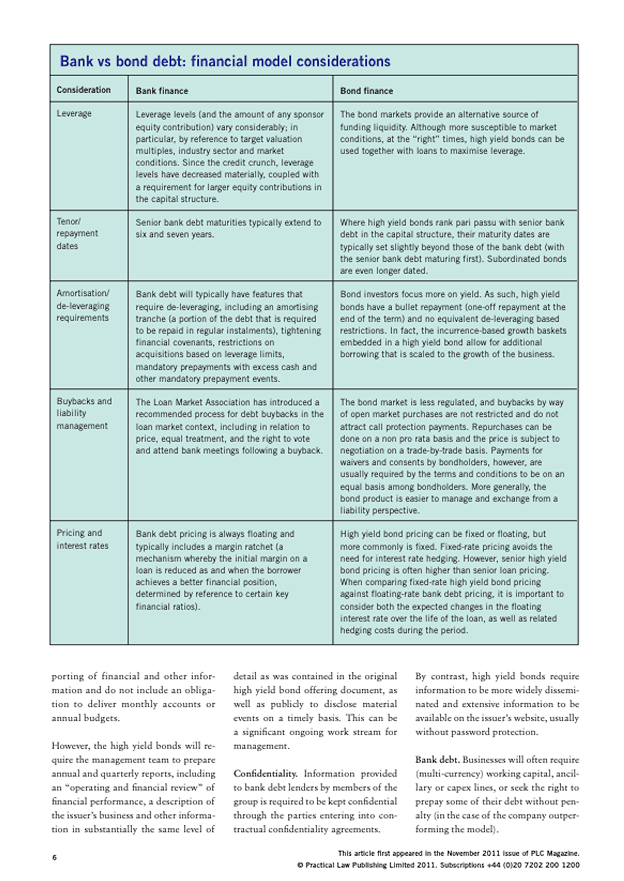

- Building Financial Models

- Creating cash flow models of the company considering future obligations.

- Calculating the optimal debt level for wealth management and risk management.

- Comprehensive Investment Management Approach

- Using stock market analysis and capital markets data.

- Planning retirement planning, asset management, and portfolio management.

- Possibility to integrate mutual funds, exchange traded funds (ETF), and hedge funds for diversification.

Practical Value for Investors

- Provides quick and reliable financing in a competitive environment.

- Reduces the likelihood of breaching financial obligations.

- Enhances transparency and control over operational activities.

- Supports effective stock trading, bonds investing, and portfolio management.

- Improves efficiency of brokerage services and guidance from a financial advisor.

Case Example

In 2022, a private investment company acquired a refrigeration equipment manufacturer in Minnesota.

- Loan amount: $150 million

- Interest rate: 4.5% per year

- Terms: allowed additional investments in production expansion without breaching financial covenants

Results:

- Increased market share by 20% over two years.

- Increased company value for subsequent sale.

- Enabled effective capital management and asset management through integration of investment strategies.

Q&A

Question

Can bank loans replace mutual funds or ETFs in private deals?

Answer

No, they serve different purposes. Bank loans provide quick financing for a specific deal, while mutual funds and exchange traded funds (ETF) are tools for investment management and portfolio diversification.

Question

Are loans suitable for risk management?

Answer

Yes, if loan conditions are carefully analyzed and integrated into an overall investment strategy and investment management plan.

Question

Which financial models are most effective?

Answer

Cash flow models that account for loan obligations and capital market forecasts. They help optimize portfolio management, asset management, and retirement planning.

Key Lessons

- Choosing the right financing is critical to the success of a deal.

- Bank loans can be an effective tool for quick and reliable financing.

- It is important to carefully analyze loan conditions and their impact on company operations.

- A comprehensive approach integrating financial consulting, bonds investing, stock trading, and capital management ensures maximum results.

This case illustrates how a financial advisor and legal support help private equity sponsors effectively use bank loans, optimize risk management, and ensure successful portfolio management.