Understanding the Fair Debt Collection Practices Act (FDCPA)

Debt collection can be a stressful experience for many individuals. However, it is important to understand that debt collectors must adhere to certain legal guidelines designed to protect consumers. One of the primary laws that regulate debt collection practices in the United States is the Fair Debt Collection Practices Act (FDCPA), enacted in 1977. This article provides an in-depth overview of the FDCPA, your rights under this law, how debt collectors can and cannot behave, and what steps you can take if your rights are violated.

The Purpose and Scope of the FDCPA

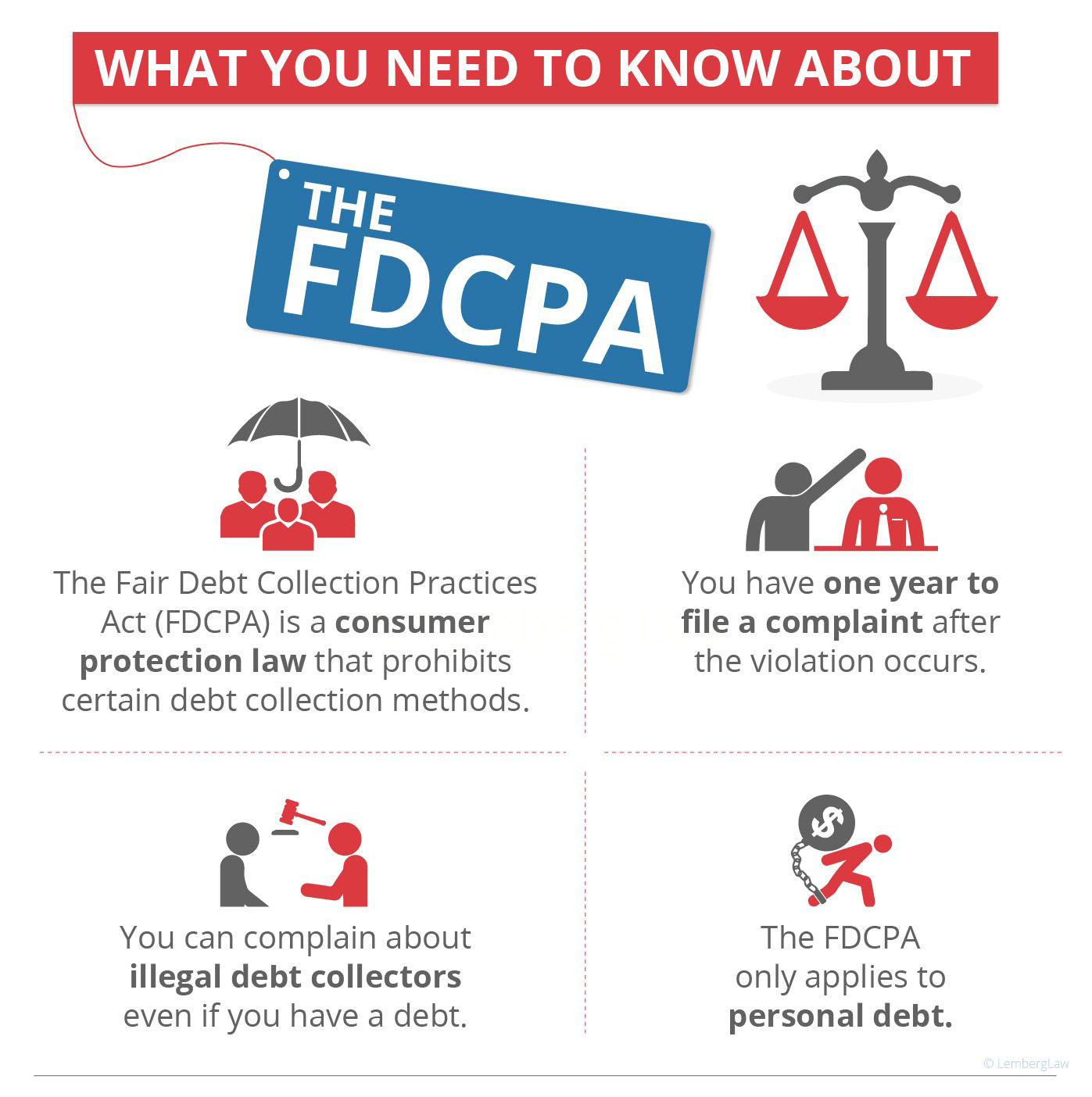

The Fair Debt Collection Practices Act was created to eliminate abusive, deceptive, and unfair debt collection practices by debt collectors. It applies to third-party debt collectors, including collection agencies, debt buyers, and attorneys who collect debts on behalf of others. However, original creditors collecting their own debts are generally not subject to the FDCPA.

The FDCPA establishes rules regarding how and when debt collectors can contact consumers, the type of language they can use, and the behaviors they must avoid. By setting these standards, the law aims to protect consumers from harassment and misinformation while still allowing debt collectors to recover debts legitimately owed to their clients.

What Debt Collectors Are Prohibited From Doing

Under the FDCPA, debt collectors must refrain from engaging in certain behaviors. Some of the prohibited actions include:

- Threatening violence or harm to the consumer, their property, or family members;

- Using obscene or profane language;

- Calling excessively or at unusual hours (generally before 8 a.m. or after 9 p.m. unless agreed upon);

- Falsely representing the amount owed or the identity of the creditor;

- Threatening legal action that is not intended or cannot be taken;

- Contacting the consumer’s workplace if the employer prohibits such communications or after being asked to stop;

- Publishing a list of consumers who refuse to pay;

- Communicating with third parties about the debt without consumer consent, except to obtain location information;

- Using deceptive means to collect debts;

- Misrepresenting the legal status of the debt or falsely implying government affiliation.

It is important to recognize these restrictions so that you can identify illegal or unethical debt collection practices and take appropriate action.

Your Rights When Dealing with Debt Collectors

Consumers have important rights under the FDCPA that provide protection and empower them to manage debt collection efforts effectively. These rights include:

- The right to request debt verification in writing: Once you receive a collection notice, you have the right to request that the debt collector provides written verification of the debt, including the amount owed and the original creditor’s information. This must be done within 30 days of the initial contact.

- The right to dispute the debt: If you believe the debt is inaccurate, you have the right to dispute it. The debt collector must then cease collection activities until they provide verification.

- The right to request that debt collectors stop contacting you: You can send a written request to a debt collector asking them to cease all communications. After receiving this request, the collector can only contact you to confirm that they will stop or to notify you of specific actions, such as a lawsuit.

- The right to privacy: Debt collectors are restricted from publicly disclosing information about your debt or contacting third parties except in limited circumstances.

- The right to be treated fairly and without harassment: Debt collectors must refrain from using threatening, abusive, or unfair practices.

How to Request Debt Verification

When contacted by a debt collector, it is wise to request verification of the debt before making any payments. This helps ensure that the debt is valid and that you owe the correct amount. Generally, you should:

- Send a written request for debt verification within 30 days of receiving the initial communication from the debt collector.

- Keep a copy of your written request for your records.

- Await receipt of the verification, which must include details such as the creditor’s name and the balance owed.

- Only proceed with payment if the information provided is accurate and you are ready to resolve the debt.

By formally requesting verification, you protect yourself from paying debts that may be incorrect, outdated, or fraudulent.

Documenting All Communications

It is essential to keep detailed records of all interactions with debt collectors. Documentation can include:

- Copies of letters and emails;

- Dates and times of telephone calls;

- Names of representatives you spoke with;

- Recordings of phone conversations, where legal;

- Notes summarizing the nature of the communications.

Maintaining thorough records serves as evidence if you need to report violations or pursue legal remedies against a debt collector. It also helps ensure that you recall the details of your communications accurately.

What to Do If Your Rights Are Violated

If a debt collector disrespects your rights under the FDCPA — for example, by threatening you, calling excessively, or contacting your workplace after you have asked them not to — you have options to respond:

- File a complaint with the Consumer Financial Protection Bureau (CFPB), which oversees debt collection practices and can investigate violations.

- Notify your state attorney general’s office or consumer protection agency.

- Consult with an attorney qualified in consumer law to understand your rights and potential remedies.

- Consider filing a lawsuit against the debt collector to recover damages caused by their unlawful conduct. Under the FDCPA, consumers may be entitled to statutory damages, actual damages, and attorneys’ fees.

Taking action not only helps protect you but can also deter debt collectors from future misconduct.

Seeking Proper Legal Assistance

Navigating debt collection laws and enforcing your rights can be complex. Professional legal guidance ensures that you understand your options and the best course of action. When facing aggressive or unlawful debt collection practices, contacting an experienced attorney can provide you with the necessary support and representation.

If you require proper legal help, feel free to reach out through the communications provided in our bio or send a private message to discuss your situation confidentially. Our team is here to assist you in protecting your rights and achieving the best possible outcome.

Conclusion

The Fair Debt Collection Practices Act is a crucial law that safeguards consumers from abusive and unfair debt collection tactics. By understanding your rights and the limitations placed on debt collectors, you can better manage any interactions with them. Always request verification before making payments, keep detailed records of communications, and do not hesitate to take legal action if your rights are violated. Remember, proper legal assistance is available to help you navigate these challenges effectively.

Legal Marketplace Consultant — a trusted company specializing in comprehensive legal services for individuals facing debt collection issues. Our expertise includes consumer protection, debt dispute resolution, and legal representation under the Fair Debt Collection Practices Act. Contact us today to learn how we can assist you.