Auditor and financial consultant with 15 years of experience, additionally involved in investing and stock markets since 2007.

Client: owner of a small business registered in the USA

Specialist: Enver Umerov — professional financial consultant from Florida

Service: development and management of an investment portfolio

Objective: preserve and grow the company’s free capital, create a source of passive income

Work format: online consultations + monthly reporting and portfolio monitoring

Initial Situation

The client, the owner of a small service-based business, approached Enver Umerov seeking advice on investing part of the company’s free circulating funds. The business had stable income and had formed a financial reserve, but the funds were simply sitting in the company’s account, gradually losing value due to inflation.

The client set clear goals:

- avoid high-risk financial instruments

- not interfere with the company’s day-to-day operations

- ensure a stable passive income

- receive regular analytics on portfolio performance

Actions of the Financial Consultant

The first step was a financial audit of the company — liquidity, debt load, and income/expense structure were assessed. After studying the business model and financial goals, a balanced investment strategy was proposed.

Main components of the portfolio:

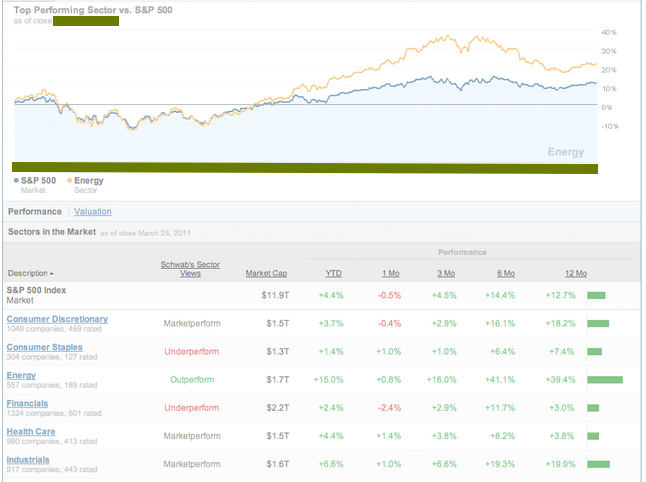

- ETFs (Exchange-Traded Funds): the core element with minimal risk

- U.S. government and corporate bonds: for steady fixed income

- Tech stocks with high growth potential: within a limited share of the portfolio for moderate growth

The client was also offered regular portfolio monitoring, including monthly reports, forecasts, and recommendations for adjusting the strategy based on market changes.

Investments were made through a Charles Schwab account — one of the most reliable U.S. brokers. The portfolio was built gradually, in full compliance with tax regulations.

Result

After just 9 months, the portfolio's return reached 14% annually, significantly exceeding the client’s goals. The portfolio remained stable even during periods of increased market volatility thanks to its risk-mitigation-focused structure.

The client noted the high quality of analytics, responsive communication, and convenient reporting. As a result, he doubled the amount of invested capital and recommended Enver to his business partners.

In addition to the financial results, the client received a clear 2-year portfolio development strategy, including tax planning and reinvestment opportunities.

This case demonstrates that even small business owners can manage their capital effectively with professional guidance. Thanks to Enver Umerov’s expertise and careful selection of instruments, the client achieved the optimal balance of profitability and safety.

A well-structured investment portfolio not only protects against inflation but also provides a stable income stream for the company. Regular analytics and monitoring allow the client to stay focused on running the business without wasting time on technical market details.

For businesses, investing is not a risk — it’s a strategy for preservation and growth when led by a professional.