Senior corporate and company lawyer with extensive international experience across the Gulf, London, New York and APAC. Background includes Partnership at a Top 10 Global Elite law firm as well as offshore law firm, and serving as Head of Legal and shadow Board Secretary at a Gulf sovereign wealth fund. Skilled in M&A, corporate governance, joint ventures, complex cross-border transactions, disputes strategy, and leadership of legal teams. Proven ability to advise C-suite and boards, manage legal operations globally, and deliver measurable value through restructuring, compliance frameworks, and high-value deal execution.

Case Context

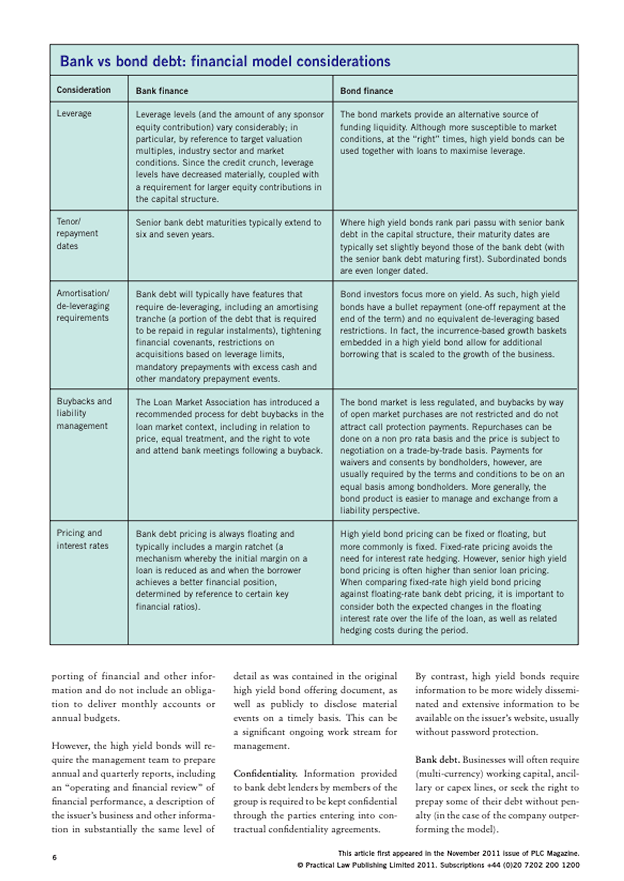

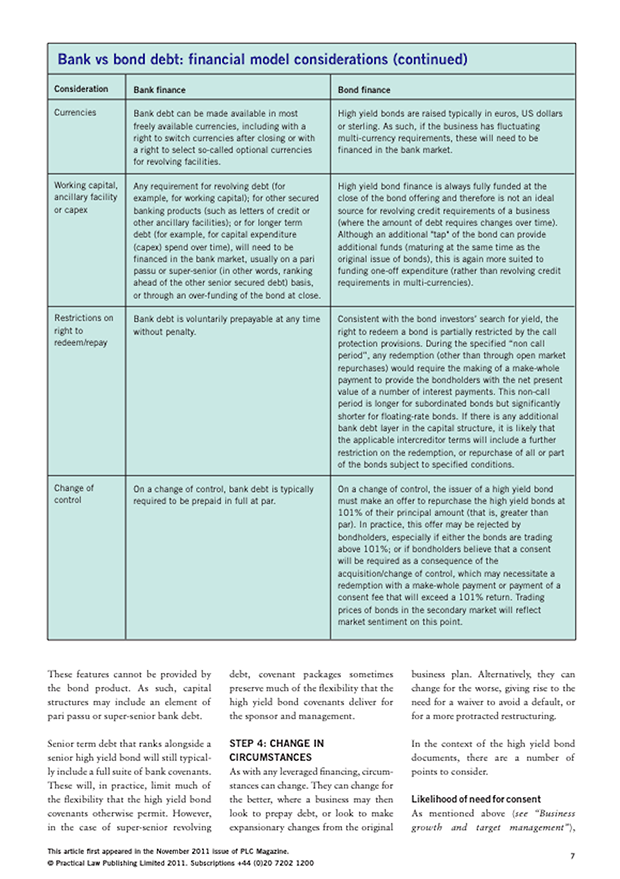

In the private equity sector, large-scale projects often require significant financial resources. Bank loans may be insufficient or constrained by strict conditions. In such cases, high-yield bonds are a key tool, enabling the mobilization of funds from institutional investors while providing greater flexibility in financing structure.

This case demonstrates a practical approach to investment advisory, asset management, and the use of investment strategies to ensure effective capital raising without losing control over the project.

Problem Statement

Key challenges that needed to be addressed:

- How to raise substantial financial resources without losing control of the company.

- How to ensure attractiveness for investors while minimizing risks.

- Evaluation of issuance costs and potential impact of market fluctuations.

Solution and Analysis

- Use of High-Yield Bonds

- Alternative to bank financing: allows raising larger amounts of capital.

- Flexible structure: bond terms, coupon rates, and repayment schedules are optimized to minimize risks.

- Market and Demand Assessment

- Analysis of capital markets and demand for bonds among institutional investors.

- Considering the use of mutual funds and exchange traded funds (ETF) to diversify the investment portfolio.

- Risk Management and Financial Planning

- Modeling scenarios of market fluctuations and their impact on bond yields.

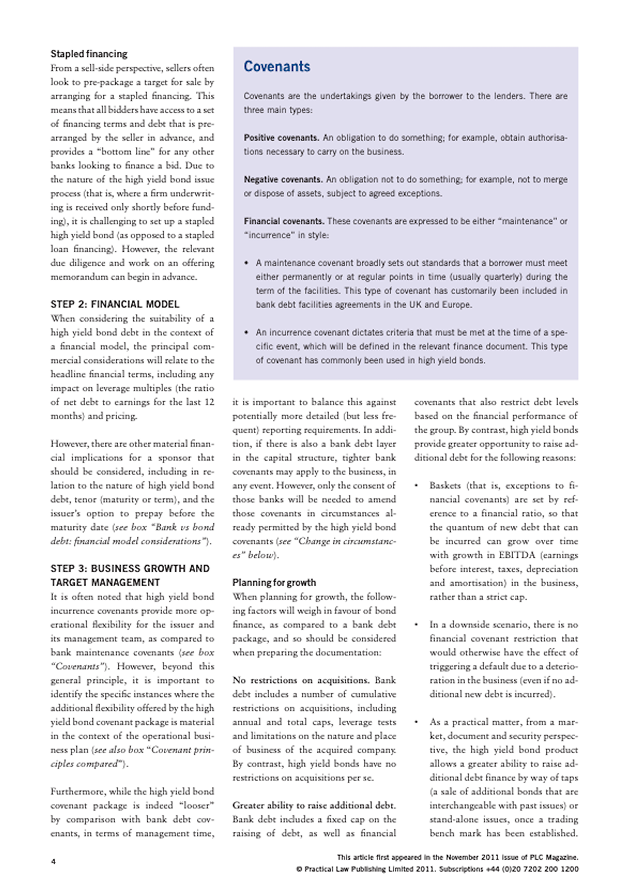

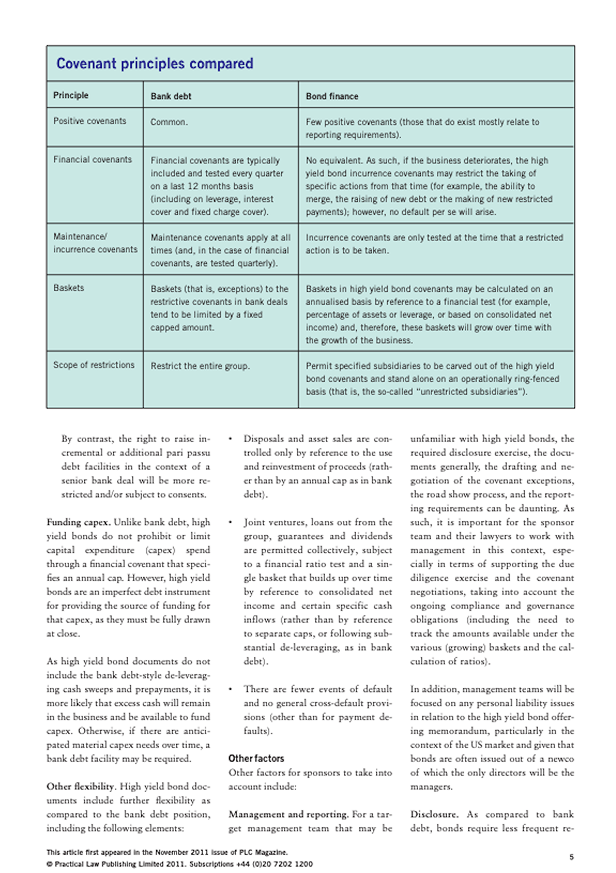

- Developing investment strategies with mechanisms to protect investors (covenants, call/put options, asset-backed security).

- Utilizing financial consulting services and guidance from a financial advisor to optimize bond structure.

- Financial Analysis and Portfolio Management

- Analysis of issuance costs: legal, underwriting, registration, and marketing expenses.

- Application of investment management, wealth management, and portfolio management techniques to improve efficiency.

- Regular financial reporting and transparent information policies to increase investor trust.

Benefits for Clients

- Quick access to large financial resources for executing large-scale projects.

- Access to institutional investors, enhancing the prestige and reliability of the deal.

- Ability to maintain control over strategic decisions and company direction.

- Optimization of risk management and investment returns.

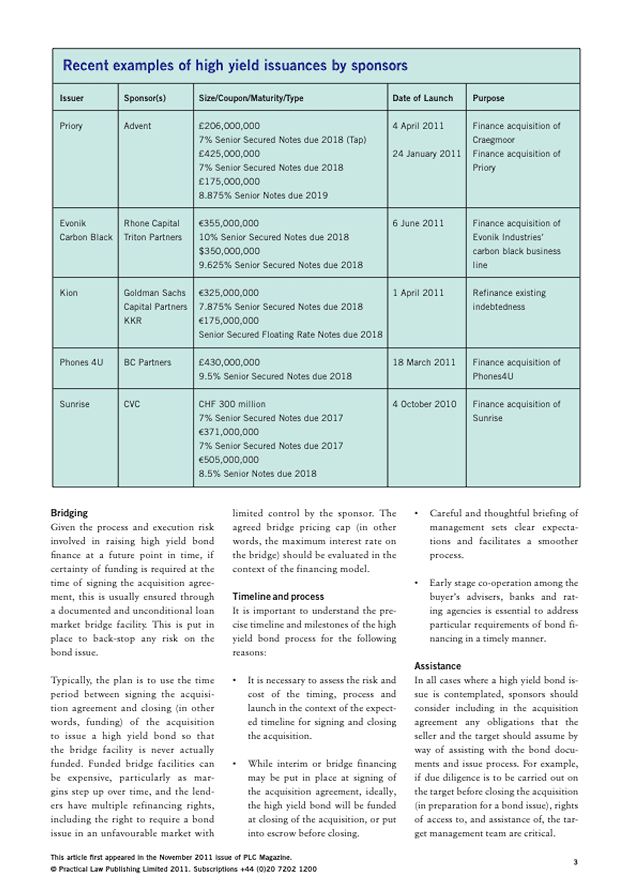

Practical Example

In 2021, a private fund raised $300 million through high-yield bonds to acquire a hotel chain in Europe.

- Coupon rate: 7% per annum.

- Maturity: 7 years.

- The bond structure allowed the fund to refinance and make capital investments without the restrictions of traditional bank loans.

- Result: modernization of hotels and a 15% increase in portfolio returns over two years.

Key Lessons

- High-yield bonds are an effective instrument for large and complex deals.

- Careful evaluation of issuance costs and market risks is essential for profitable financing.

- A systematic approach to bond structuring and investor protection ensures the success of the deal and long-term stability.

- Using financial planning services, asset management, portfolio management, and risk management enhances capital raising efficiency.

Frequently Asked Questions

Question

Why not rely on bank loans?

Answer

Bank loans are often limited in size and conditions, whereas high-yield bonds offer flexibility tailored to project needs.

Question

What are the risks of bond issuance?

Answer

Risks include capital market fluctuations, interest rate changes, and issuance costs. Financial consulting and stock market analysis are key to mitigating these risks.

Question

How can investors be attracted?

Answer

Through transparent information policies, regular financial reporting, and leveraging mutual funds, ETF, brokerage services, and hedge funds.

Raising high-yield bonds for private deals is an effective tool for investment management and wealth management in large-scale projects. This approach allows:

Flexibility in financing unattainable with bank loans;

Access to large sums from institutional investors;

Maintaining control over strategic company decisions;

Optimization of risk management and portfolio returns;

Integration of mutual funds, ETF, hedge funds, and brokerage services to diversify investments.

A comprehensive approach including financial planning services, investment advisory, asset management, portfolio management, and retirement planning ensures transparency and stability in the investment process.

We are ready to provide comprehensive solutions in investment management, investment advisory, and financial planning services, assist with stock trading, bonds investing, ETF, mutual funds, and hedge funds, and develop tailored investment strategies and portfolio management to achieve your business objectives.