Forbes-recognized counsel and architect of the COMPASS framework, a strategic breakthrough for navigating international investments and business expansion, with over 5 years of experience in corporate law, including investment management, VC/PE, and cross-border transactions, contributing $15B+ in transactions across diverse sectors.v

$10M Investment in Uzbekistan's Agrochemical Sector: Legal Architecture of a Pioneering Case by Miraziz Khidoyatov

This case outlines the strategic legal support for a complex private investment of USD 10 million in Uzbekistan’s agrochemical industry. The project became the first large-scale foreign investment in a sector that lacked an established regulatory framework or precedent. Our approach involved the construction of a unique multi-tier governance structure that combined foreign investor control with the autonomy of the local enterprise.

Implementation required deep understanding not only of legal frameworks but also of the business cultures of Uzbekistan and Japan. Thanks to strategic balancing of interests, we managed to create a precedent that later became a catalyst for further international investments in the region.

Main Legal Challenges

- Absence of clear legal norms on private foreign investment in the sector

- Conflicting expectations over control between the investor and the local partner

- Need for a unique legally binding decision-making model

- Risk of trust breakdown due to cultural differences in business practices

- Weak protection of the investor’s interests under immature regulation

Legal Stages of Investment Implementation

- Industry analysis for any restrictions on foreign capital

- Establishment of a corporate structure with multi-level governance

- Development of a competence-sharing model between the parties

- Legal confirmation of control and autonomy mechanisms

- Agreement of the model with Uzbekistan’s regulatory bodies

- Execution of contracts with reference to foreign law

- Final structuring of the deal and transaction monitoring

What Was Achieved

- Implementation of a multi-tier decision-making model

- Investor obtained strategic-level management control

- Local company retained full operational autonomy

- Legal protection of parties’ rights in the event of disputes

- Created a template for future investments in the industry

Advantages of the Implemented Approach

- Balance of partner control and autonomy

- Full legal compliance with national and international law

- Precedent-setting model for other investors in the agrochemical sector

Turnkey Legal Structuring of Investment

Approval of the Scheme by Regulators

Strategic Partnership Adapted to Local Context

Question

Why is this case considered pioneering?

Answer

Before this transaction, there were no regulatory practices for such foreign investments in the sector. We created a legal model that was recognized as effective by all parties involved.

Question

What benefit did the Uzbek side receive?

Answer

The local enterprise retained operational autonomy, received investment, and was able to scale production and enter international markets with the support of an experienced partner.

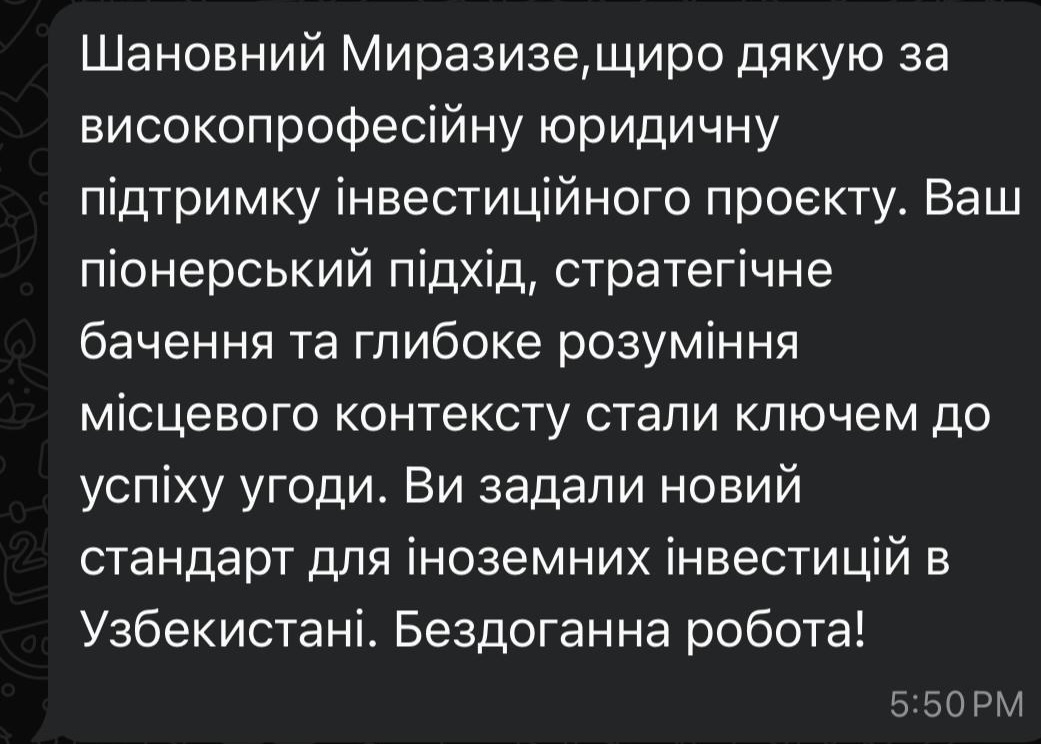

This case demonstrates how innovative legal thinking can unlock the potential of a sector previously closed to foreign investment. Thanks to the creation of a unique partnership model, the investment became not only beneficial to all parties but also set new standards for Uzbekistan’s agrochemical market. Thorough legal structuring, strategic vision, and deep understanding of local conditions were the key to the project's success.