Tax Rules for Non-Resident Investors in the U.S.

Investing in the United States provides significant opportunities for non-resident investors. However, it also introduces a complex landscape of tax obligations that must be navigated carefully. Non-resident aliens – individuals who are not U.S. citizens or resident aliens – who earn income in the U.S. are subject to specific U.S. tax rules. Understanding these rules, including withholding tax rates, the Foreign Investment in Real Property Tax Act (FIRPTA), and treaty exemptions, is essential to maximize profit and ensure compliance. This article, presented by Legal Marketplace CONSULTANT, offers a comprehensive guide to the tax framework applicable to non-resident investors in 2025.

Understanding Non-Resident Alien Status

Before delving into tax rules, it is important to understand who qualifies as a non-resident alien (NRA). According to the Internal Revenue Service (IRS), a non-resident alien is an individual who is neither a U.S. citizen nor meets the substantial presence test or holds a green card. The substantial presence test considers the number of days a person has been physically present in the U.S. over a three-year period.

For NRAs, U.S. tax obligations depend largely on the source and type of income earned in the country. Income connected with a trade or business in the U.S. is generally taxed differently from passive income such as dividends, interest, or capital gains.

Taxation of U.S. Source Income for Non-Resident Investors

Non-resident investors are taxed on their U.S. source income, which includes various types such as:

- Interest income from U.S. sources;

- Dividends from U.S. corporations;

- Rental income from real property located in the U.S.;

- Capital gains from the sale of U.S. real property or certain U.S. securities;

- Income effectively connected with a U.S. trade or business (ECI).

The taxation method varies between fixed withholding rates and graduated tax rates depending on the income type. In many cases, withholding tax is applied at source by payers, ensuring compliance from the outset.

Withholding Tax Rates and Mechanisms

One of the foundational components of the U.S. tax system for non-resident investors is the withholding tax. This tax is typically withheld at the source before payments are made to the non-resident, and it serves as a prepayment of income tax obligations.

Common withholding tax rates for non-resident aliens on U.S. source income are as follows:

- 30% on dividends;

- 30% on fixed or determinable annual or periodic income such as interest, rents, and royalties;

- Capital gains are generally exempt except in specific conditions;

- Income effectively connected with a U.S. trade or business is taxed at graduated rates applicable to U.S. residents.

These withholding rates may be reduced or eliminated by applicable tax treaties between the U.S. and the non-resident investor's country of residence.

The Foreign Investment in Real Property Tax Act (FIRPTA)

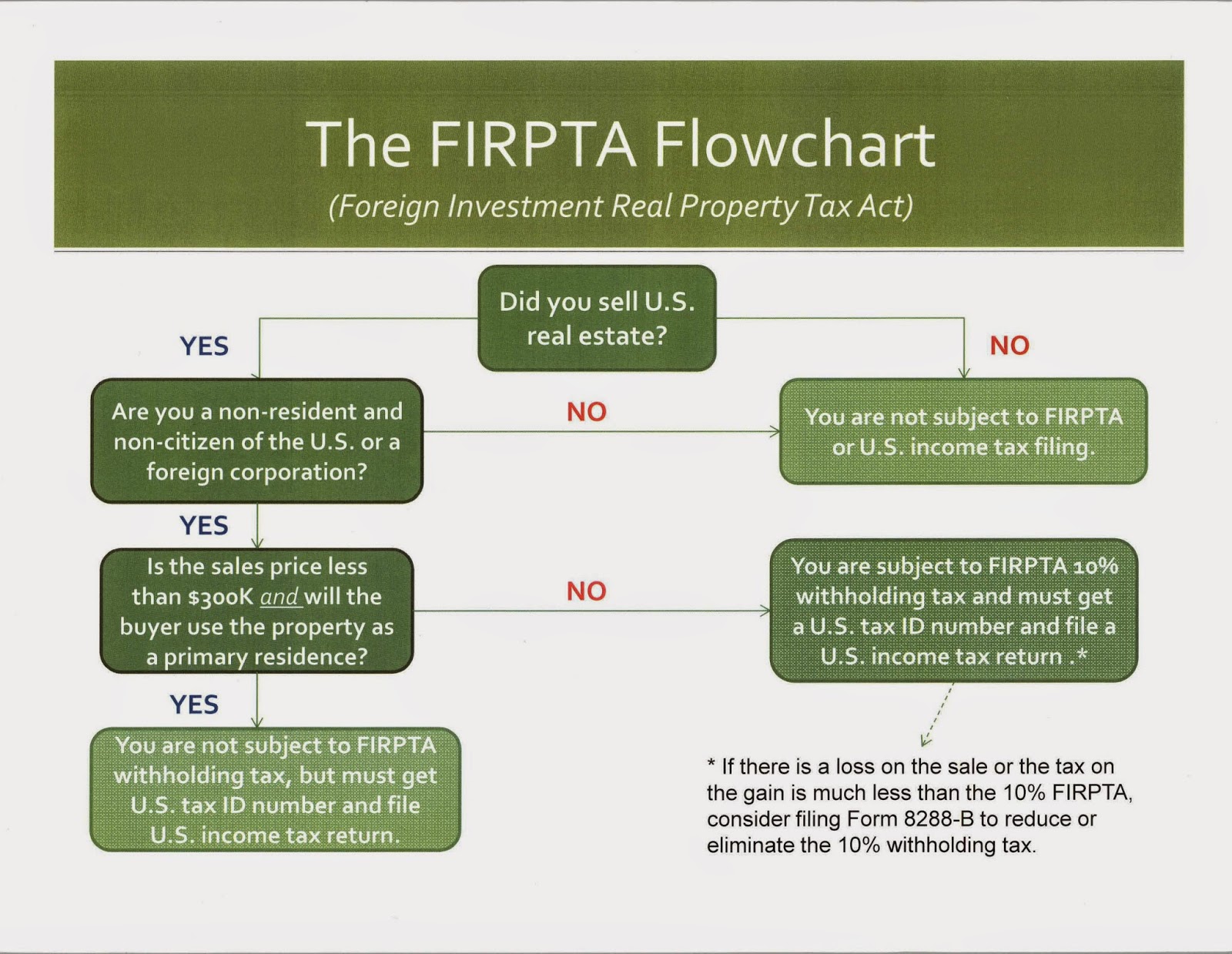

The Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) imposes special rules on the dispositions of U.S. real property interests (USRPIs) by non-resident aliens and foreign corporations. Under FIRPTA, the gains realized from the sale of U.S. real estate by foreign persons are subject to U.S. income tax as effectively connected income.

Key provisions of FIRPTA include:

- A withholding tax of 15% (as of 2025) on the amount realized from the sale, generally withheld by the buyer;

- The requirement for buyers to withhold this amount to ensure tax compliance;

- The seller's ability to file a U.S. tax return to calculate the actual tax liability, which may be different from the withheld amount;

- Potential exemptions or reductions based on the property's use, such as if the property is used as a residence under a certain price threshold.

Non-resident investors need to plan accordingly to manage FIRPTA withholding and tax liabilities effectively.

Tax Treaties and Their Role in Tax Reduction

The United States has tax treaties with more than 60 countries which often provide reduced withholding tax rates or exemptions on certain types of income. These treaties are designed to prevent double taxation and encourage cross-border investment.

Important aspects of U.S. tax treaties include:

- Reduced withholding rates on dividends, interest, and royalties;

- Exemption or reduction of tax on capital gains in certain circumstances;

- Clarification of residency to avoid dual residency issues;

- Provisions requiring taxpayers to claim benefits by filing appropriate IRS forms, such as Form W-8BEN for individuals.

Non-resident investors should consult tax professionals to understand and leverage treaty benefits applicable to their specific situation.

Filing Requirements for Non-Resident Investors

Non-resident aliens earning U.S. income may need to file U.S. tax returns depending on the nature of their income:

- Form 1040-NR is the primary tax return for non-resident individuals engaged in a U.S. trade or business or who have effectively connected income (ECI);

- Form 1120-F for foreign corporations with income effectively connected with a U.S. trade or business;

- Forms related to withholding, such as Form 8288 and 8288-A for FIRPTA withholding;

- Form W-8BEN or W-8BEN-E to claim treaty benefits and to certify foreign status to withholding agents.

Proper and timely filing helps avoid penalties and ensures compliance with U.S. tax laws.

Planning Strategies to Optimize Tax Outcomes

Effective tax planning is crucial for non-resident investors to optimize returns and minimize tax liabilities. Some recommended strategies include:

- Utilizing tax treaties diligently to reduce withholding taxes;

- Structuring investments to qualify as income effectively connected with a U.S. trade or business, allowing graduated tax rates to apply instead of flat withholding rates;

- Planning dispositions of U.S. real property interests with FIRPTA requirements in mind;

- Consulting qualified tax advisors who understand the nuances of U.S. tax law and international tax treaties;

- Considering the use of entity structures, such as LLCs or corporations, to achieve favorable tax treatment.

Thorough planning can result in significant tax savings and reduce risks of non-compliance penalties.

Common Challenges Faced by Non-Resident Investors

Despite the opportunities, non-resident investors face several challenges related to U.S. taxation, including:

- Complexity of U.S. tax laws and frequent changes;

- Navigating the documentation and procedural requirements for claiming treaty benefits;

- Understanding FIRPTA withholding and securing proper certificates to reduce withholding;

- Dealing with different tax treatments based on entity type and source of income;

- Potential exposure to double taxation if treaty benefits are not properly claimed.

Working with experienced legal and tax professionals mitigates these issues significantly.

Recent Updates and Trends for 2025

Tax laws are subject to ongoing modifications. In 2025, notable updates impacting non-resident investors include:

- An increase in the FIRPTA withholding rate from 10% to 15%, aligning with efforts to ensure appropriate tax collections on foreign investments;

- Expanded IRS focus on compliance enforcement concerning withholding and reporting by foreign investors;

- New guidance on digital asset taxation affecting foreign investors holding cryptocurrencies or digital tokens in U.S. accounts;

- Ongoing modernization of tax treaties and increased cooperation between countries to prevent tax evasion.

Staying updated with these trends is imperative for informed investment decision-making.

How Legal Marketplace CONSULTANT Can Assist Non-Resident Investors

Legal Marketplace CONSULTANT specializes in providing comprehensive legal and tax consulting services specifically tailored for non-resident investors in the United States. We offer expertise in:

- Tax planning and structuring investments to maximize treaty benefits;

- FIRPTA compliance and withholding management;

- Assistance with IRS filings and documentation preparation;

- Guidance on recent tax law changes and their implications;

- Representation in discussions or disputes with tax authorities.

Proper legal and tax guidance is essential to safeguard your investments and optimize returns. For personalized assistance and consultations, please contact us via the communication channels listed in our bio or send a private message.

Summary

Navigating the U.S. tax system as a non-resident investor is a complex but manageable endeavor. Understanding the withholding tax framework, FIRPTA rules, and available treaty benefits are key components of effective tax management. By leveraging expert advice and proactive planning, non-resident investors can significantly enhance their investment outcomes while ensuring compliance with U.S. tax laws in 2025 and beyond.

The tax environment for non-resident investors in the U.S. demands careful attention and skilled navigation. Withholding taxes, FIRPTA regulations, and international tax treaties interact to shape the overall tax obligations. Legal Marketplace CONSULTANT is committed to supporting non-resident investors through expert guidance and tailored strategies to protect investments and optimize profits. If you require comprehensive legal assistance or tax advice, reach out to us through the provided communication channels or direct message for personalized support.

Legal Marketplace CONSULTANT is a leading firm specializing in comprehensive legal and tax consulting services for businesses and individuals. Our multidisciplinary team includes attorneys, tax consultants, auditors, and accountants dedicated to providing tailored solutions that drive success and compliance.