My name is Kora Lina. I am a financial consulting specialist from California. The key areas of law in which I work are corporate finance and banking law. My work experience is more than 10 years in various specializations.

Service: Personal Credit History Restoration in the USA

Objective

Oleksii, a 43-year-old man who has been living in the USA for over 10 years and works as a professional truck driver, sought financial help due to a critical issue — a significant deterioration of his credit history.

After a serious car accident, he was injured and unable to work for several months. Due to the loss of income, Oleksii could not make timely payments on his auto loan, credit card, and medical bills. As a result, multiple delinquencies appeared in his credit history, and his FICO score dropped to a "bad" level, making it virtually impossible to access any credit products — even basic ones such as phone installments or housing rentals without a co-signer.

The client aimed to:

- clean the credit history from delinquency records;

- rebuild his credit score;

- prepare himself for obtaining new credit — initially consumer credit, and later for fleet upgrades;

- become financially independent and creditworthy again.

Financial Expert Strategy

Developing a personalized credit restoration plan included a comprehensive, multi-step approach that combined both technical and educational tools:

1. Credit Report Analysis

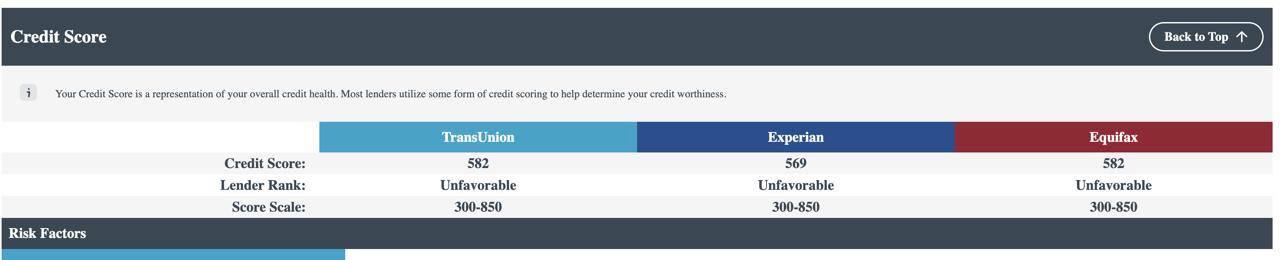

Reports were requested from the three major US credit bureaus — Equifax, Experian, and TransUnion, revealing that:

- there were 4 delinquent payment records (two credit cards, auto loan, and medical debt);

- 5 unauthorized hard inquiries had been made (including from third-party financial companies when Oleksii was job searching and had shared personal data that was later used without written consent);

- discrepancies in the reports regarding the account opening dates and credit card limits.

2. Working with Credit Bureaus

After gathering all necessary documentation, the following were prepared and sent:

- formal written disputes to each bureau citing inaccuracies, violations of the Fair Credit Reporting Act (FCRA), and demanding corrections or removal of incorrect records;

- legally grounded cover letters with supporting documentation (such as bank statements, medical records, hospital documents) validating the legitimate reasons for delayed payments;

- requests to remove unauthorized hard inquiries.

The process with the bureaus took about 45 days, after which updated credit reports were received showing most negative records had been removed.

3. Restoring Financial Tools

After partial cleanup of the history, the next step was gradually building up positive credit activity:

- the client was advised to open a secured credit card with a $500 deposit;

- instructions were given on keeping credit utilization below 10–15% and making timely payments;

- automatic payment reminders were set up to prevent new delinquencies.

A personal financial plan was also created to track income and expenses, including recommendations for building an emergency fund for future unforeseen events.

4. Educational Support

Oleksii received individual online sessions on financial literacy, including:

- how the US credit system works;

- why it’s important to have diverse credit lines (auto loan, credit card, installment plans, etc.);

- how to build a responsible and long-term credit history.

This helped not only restore the credit record but also develop financial management skills for the future.

Results

Thanks to a comprehensive approach and consistent execution of all steps, within 5 months the following results were achieved:

- 4 delinquencies and 5 hard inquiries were successfully removed;

- FICO score increased by 120 points — from 540 to 660;

- Creditworthiness restored: the client independently obtained an auto loan of $18,000 at 8.99% without a co-signer;

- Oleksii returned to his professional career and began planning a future business in freight transportation.

This case clearly demonstrates that even in the most critical situations — when it seems the financial system has closed all doors — the right strategy and expert support can change everything. Oleksii not only improved his credit history but also regained confidence and financial control over his life.

Looking for a specialist who can help you restore your credit score, remove negative records, or prepare for major financing?

📩 Contact me — your personal financial consultant from California. I’ll help you regain the trust of lenders and move confidently toward your financial goals.