The key areas of law in which I work are cross-border contract law, compliance with international business legislation, legal support for IT companies, and legal protection of businesses in different countries.

Client's Request

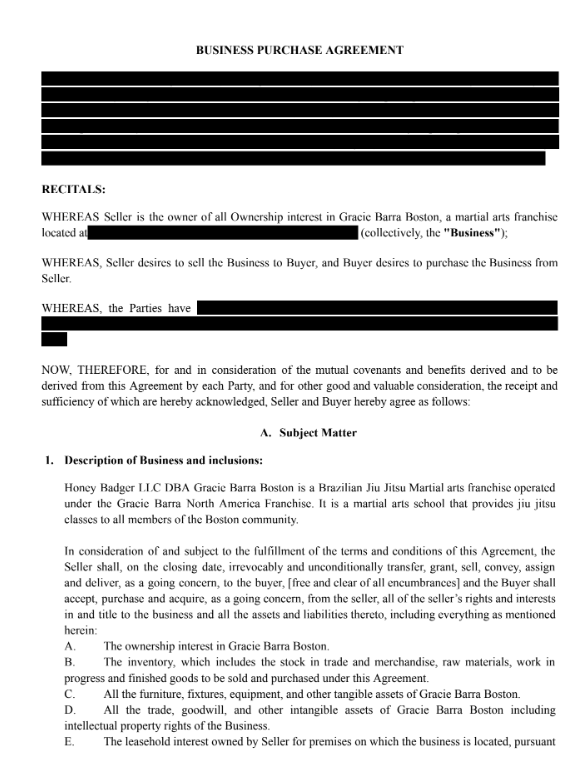

A client — the owner of the Gracie Barra Boston martial arts franchise — contacted me with a clear request: legal support for the full sale of business ownership. The transaction involved the transfer of all company assets, including both tangible and intangible assets such as inventory, equipment, intellectual property, goodwill, lease rights, and all associated documentation.

The client's main objectives were:

- to ensure a legally clean and seamless transfer of ownership to the new buyer;

- to avoid any legal liability after the deal closure;

- to clearly outline the payment structure and settlement timelines;

- to eliminate the risk of potential disputes in the future.

Given the importance of the transaction for the client’s future business plans, each step of the process required a high degree of accuracy, caution, and strategic insight.

Legal Solution

After a thorough analysis and legal review of the assets, I drafted a comprehensive Business Purchase Agreement between the parties:

- Honey Badger LLC (Seller) — the client’s company;

- MAISUM ONE MORE LLC (Buyer) — the legal entity interested in purchasing the business.

The agreement included detailed provisions regarding:

🔹 Assets being sold:

The agreement covered the sale of full ownership, inventory, equipment, trademark, goodwill, lease rights, and all licenses and permits related to business operations.

🔹 Exclusion of liabilities:

To protect the client after the deal closure, I included a clause stating that the Seller bears no responsibility for any debts or obligations arising after the closing date. Specifically, the SBA loan obligation received in response to COVID-19 was explicitly excluded. This safeguarded the client from potential claims by creditors or government agencies in the future.

🔹 Payment structure:

The purchase price was set at $20,000, with a clear payment procedure:

- $500 — advance payment made by the Buyer upon signing the agreement;

- $19,500 — remaining balance to be paid on the closing date, scheduled for November 31, 2023.

This ensured that the client had proof of the Buyer’s serious intent while maintaining financial control until the final transfer of ownership.

🔹 Additional warranties and representations:

I included provisions outlining the warranties and representations of both the Seller and Buyer, ensuring the legal clarity of the transaction, confirmation of ownership, absence of undisclosed obligations or third-party claims, and the absence of ongoing litigation or administrative investigations.

Result

Thanks to a carefully planned legal strategy, the client was able to successfully sell the Gracie Barra Boston franchise in full. The transaction was completed on time, without delays or conflicts, and the document structure provided legal protection even after ownership transfer.

The results of my work included:

- a transparent and legally sound transfer of the business;

- clear settlement of financial terms;

- minimized risks for both parties;

- strengthened the client’s reputation as a responsible business partner.

This case demonstrates how a comprehensive approach to drafting a business purchase agreement can not only protect the Seller’s interests but also ensure smooth cooperation between the parties. With properly structured terms and legal guidance, the client received maximum protection and achieved the goal of selling the business on favorable terms without future legal risks.

If you are planning to sell a company, business share, or commercial franchise, feel free to contact me — I will help you complete the deal professionally, transparently, and with your interests in mind.