My name is Kora Lina. I am a financial consulting specialist from California. The key areas of law in which I work are corporate finance and banking law. My work experience is more than 10 years in various specializations.

Service: Credit History Restoration and Legal Clarification of Financial Obligations

The Case

Alina, a 34-year-old woman, moved to the United States with her husband and three children in search of a better future. The family rented a home, adapted to their new life, and Alina obtained a work permit and found a job as a preschool teacher. Everything seemed stable—regular payments, no delinquencies, and moderate use of credit cards. However, the family soon found themselves in a crisis that led to the decision to divorce.

That’s when Alina discovered that her financial situation wasn’t just unstable—it was disastrous. Her credit score had dropped by nearly 150 points, even though she hadn’t opened any new credit accounts and had made all her payments on time. A review of her credit report revealed shocking details:

- Several credit cards had been opened in her name without her knowledge. These accounts carried debts and late payments.

- Her husband had taken out a joint auto loan of $27,000 without informing her, and the payments had been delinquent for months.

- Other accounts were opened using her Social Security Number—likely as a result of familial fraud.

Under the marital laws of most U.S. states, debts incurred during a marriage are considered joint obligations—even if one spouse was unaware of or did not consent to the debt. This meant that Alina was legally responsible for her husband’s hidden debts.

Financial and Legal Expert Strategy

1. Credit History and Legal Situation Assessment

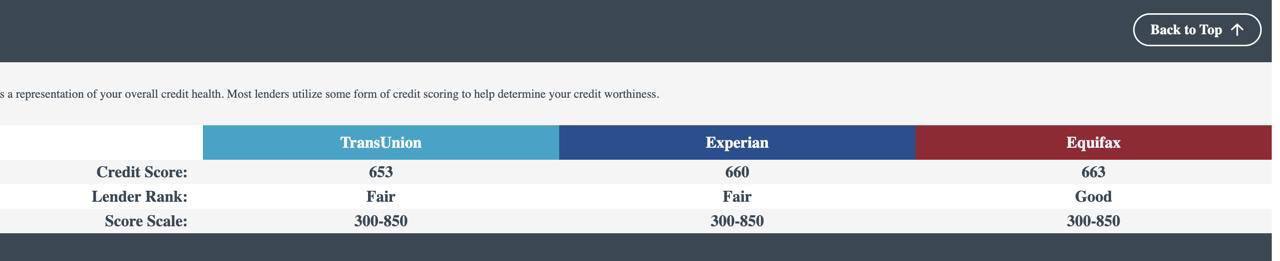

A full credit report was requested from all three major credit bureaus—Experian, Equifax, and TransUnion. A detailed audit was conducted to identify all suspicious and fraudulent credit lines. A legal strategy was developed to dispute her liability for debts incurred without her consent.

2. Disputing Illegitimate Debts

Based on the Fair Credit Reporting Act (FCRA) and identity protection laws, formal disputes were submitted to each credit bureau. Fraud alerts were added, and evidence (witness statements, documents, and a police report) was provided. As a result, the fraudulent accounts were removed from Alina’s credit history within 45 days.

3. Restructuring Legitimate Debts

For accounts where Alina was the legitimate account holder (such as a small installment loan and a personal credit card), negotiations were held with creditors. A restructured payment plan with lower monthly installments and a reduced interest rate of 7.9% was agreed upon.

4. Rebuilding Credit Profile

To boost her credit score, Alina was added as an authorized user (AU) on her sister’s credit card, which had a long positive history. She also opened a secured credit card with a $300 deposit, used it responsibly (keeping utilization below 10%), and made timely payments.

Credit monitoring tools like Credit Karma and Experian were implemented to track future activity and prevent new instances of fraud.

Results After 4 Months

- FICO credit score increased from 540 to over 660—a rise of more than 120 points.

- All unauthorized accounts were removed, reducing her reported debt by over $18,000.

- Alina was approved for an unsecured credit card with a $5,000 limit from a credit-builder-friendly bank.

- She was able to independently apply for a new rental home for herself and her children without needing a co-signer or extra deposit.

A personal financial plan and emergency fund covering 3 months of living expenses were established to ensure future stability.

This case clearly illustrates how trust within a marriage can lead to significant financial damage—but it also shows that with professional help, even the most complex situation can be resolved. Alina not only cleared her credit report but also regained full financial independence. Proper documentation, targeted disputes, and a structured rebuilding strategy enabled her to come out of the crisis more informed and more empowered.

If you find yourself in a similar situation, don’t delay. Your credit history is your financial reputation—protect it with the same care as your name. Contact us, and together we’ll help you regain control over your life.

.jfif)