Senior corporate and company lawyer with extensive international experience across the Gulf, London, New York and APAC. Background includes Partnership at a Top 10 Global Elite law firm as well as offshore law firm, and serving as Head of Legal and shadow Board Secretary at a Gulf sovereign wealth fund. Skilled in M&A, corporate governance, joint ventures, complex cross-border transactions, disputes strategy, and leadership of legal teams. Proven ability to advise C-suite and boards, manage legal operations globally, and deliver measurable value through restructuring, compliance frameworks, and high-value deal execution.

Case Context

Auction situations and non-standard projects often require an unconventional approach to financing. Private equity sponsors face the challenge of not only raising funds but also optimally combining various financing sources while maintaining control over the target company and minimizing financial and tax risks.

Particular attention must be paid to international taxation, business structuring, and tax planning. Proper integration of financial instruments with tax planning allows achieving tax efficiency, tax optimization, and reducing overall tax burden.

Problem Statement

- How to select the most effective type of financing in competitive or non-standard transactions?

- How to combine different financial instruments to maintain control of the company and minimize expenses?

- How to account for US taxes and other tax jurisdictions in international transactions?

In complex deals, risks are elevated, and competition is fierce. Therefore, strategic financing requires a comprehensive approach, including:

- tax planning;

- tax optimization;

- tax risk management;

- offshore planning for international operations.

Solution and Analysis

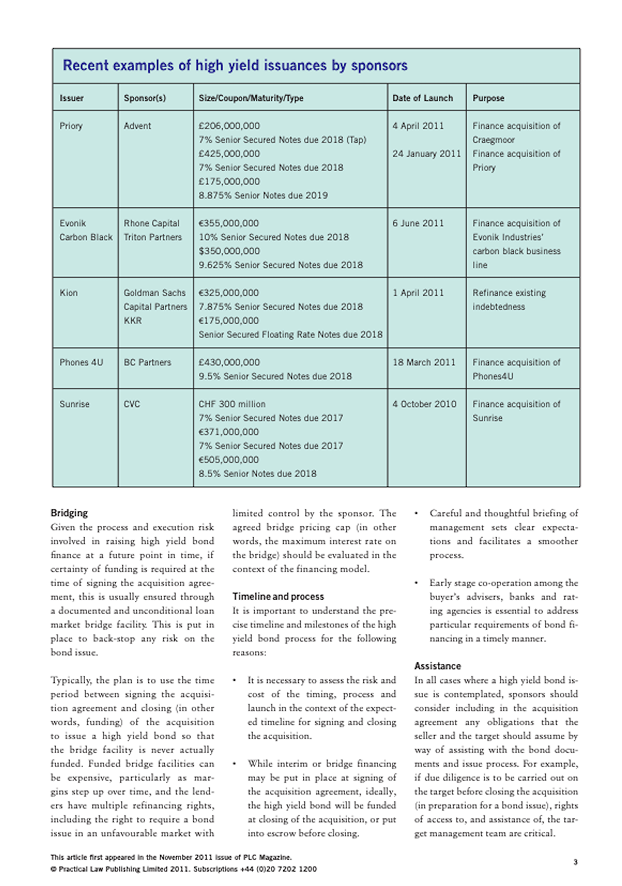

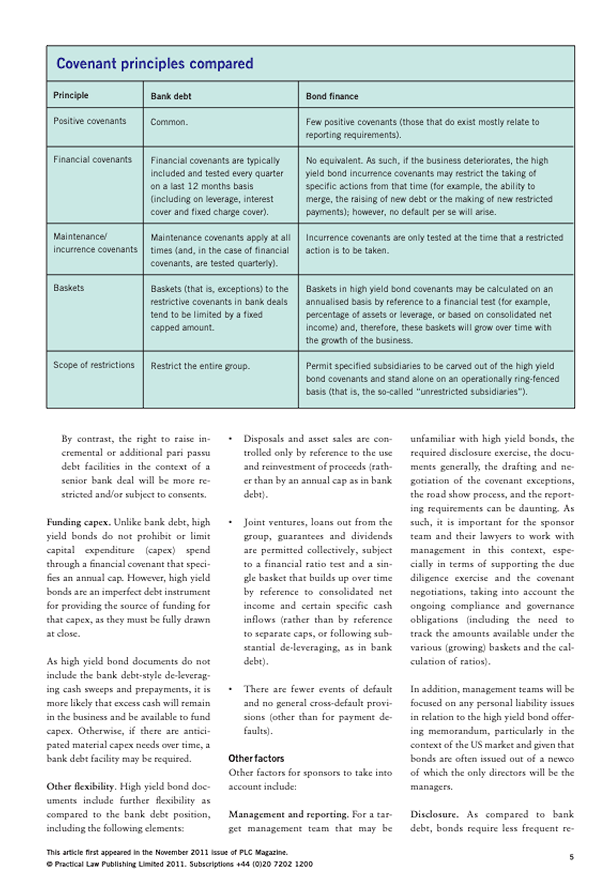

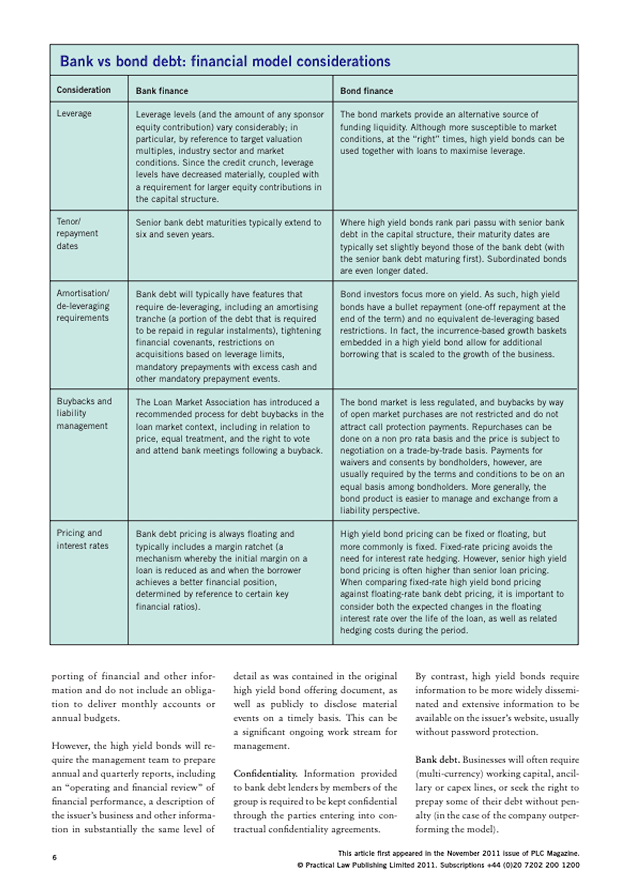

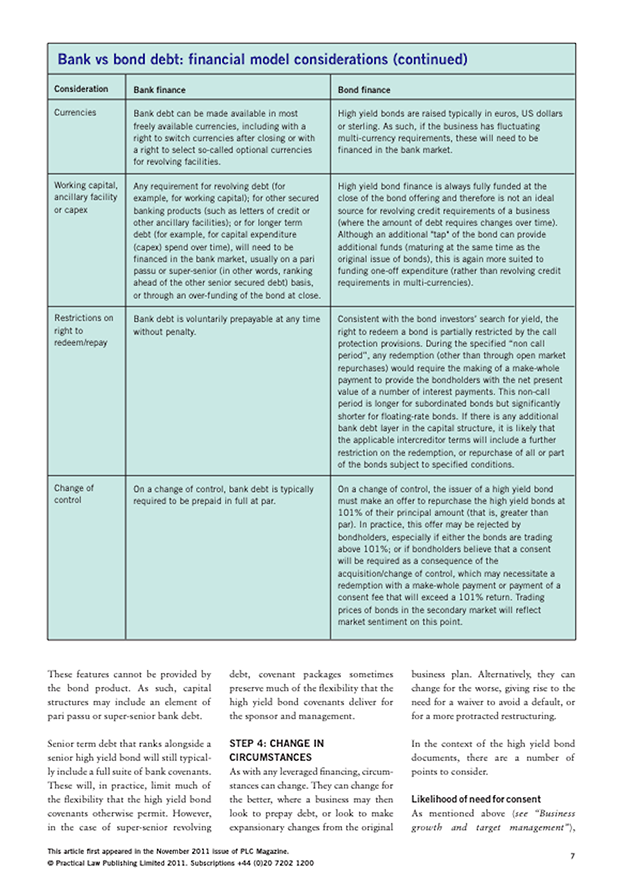

- Comparison of Bank Loans and High-Yield Bonds

| Instrument | Advantages | Limitations |

|---|---|---|

| Bank loans | Fast financing, lower interest rates | Limited flexibility, covenant requirements |

| High-yield bonds | Large amounts, flexible terms | Higher issuance costs, market risks |

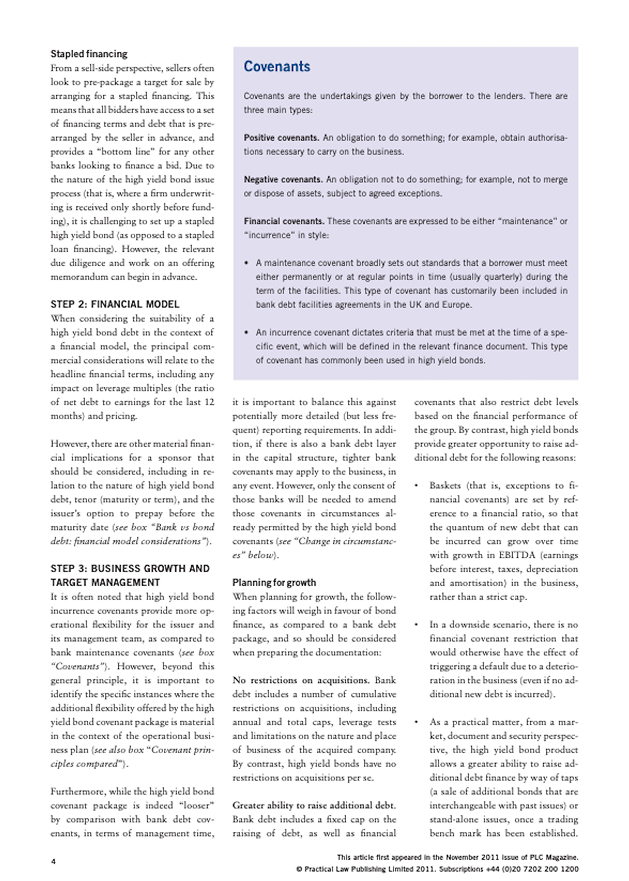

- Tax considerations:

- Bank loans allow interest payments to be treated as expenses, reducing overall tax burden.

- Issuing bonds may require taxation of non-resident income, necessitating analysis of different tax jurisdictions.

- Impact of Financing on Company Development

- Assessing refinancing and future investment opportunities.

- Determining limitations on capital and operational expenditures under debt load.

- Business structuring with tax planning to mitigate tax risks.

- Risk Mitigation and Profit Maximization Strategies

- Combining funding sources: partial bank loan and partial bond issuance.

- Using financial models to forecast cash flows and risk scenarios.

- Incorporating investor protection mechanisms to enhance deal attractiveness and reduce tax risks.

- Offshore planning and international taxation to optimize tax payments across jurisdictions.

Practical Application

In 2022, a private fund participated in a competitive auction to acquire a medical company in Western Europe.

- Bank loan: $100 million — fast funding.

- High-yield bonds: $150 million — flexible terms and significant capital.

Results:

- The fund maintained control of the company and executed further investments in technology development and market expansion.

- The company increased profits by 25% within a year.

- Investors achieved expected returns, and a tax advisor helped optimize tax efficiency and reduce overall tax burden.

Q&A: Tax Considerations

Question

Are bank loans always better than bonds from a tax perspective?

Answer

Not always. Bank loans allow interest expenses to reduce overall taxes, but bonds can be advantageous for large deals or when flexible terms are needed. Analysis of tax jurisdictions and tax planning is crucial.

Question

How can tax burden be reduced in international transactions?

Answer

Through offshore planning, proper business structuring, and consulting a tax advisor for US taxes and other jurisdictions.

Question

Can multiple funding sources be combined?

Answer

Yes, strategically combining loans and bonds allows adaptation to market conditions, maintains control of the company, and improves tax efficiency.

Question

What tax risks should be considered?

Answer

Potential tax penalties, double taxation, risks of improper business structuring, and non-compliance with international taxation rules.

Strategic financing in private equity requires a comprehensive approach combining:

Analysis of financial instruments;

Tax planning and tax optimization;

Tax risk management and offshore planning;

Consideration of international taxation and US taxes.

Effectively integrating these elements allows investors to achieve tax efficiency, maintain control, and increase deal profitability.

📌 Contact us today: Schedule a consultation with our tax advisor to design the optimal financing and tax strategy for your transaction.