Hello! My name is Oleg Lestunov. Currently, I work as a paralegal at a law firm in Boston specializing in Landlord & Tenant Law. Our firm serves clients across the entire state and covers the whole New England region — one of our major strengths. In addition, I assist individuals with immigration matters at the federal level across all U.S. states. I also help clients — both U.S. residents and foreign entrepreneurs — with starting corporations and opening business bank accounts. If you have any questions, I’ll be happy to help. Don’t hesitate to reach out!

Business Registration in the USA — Support at Every Stage, from Entity Selection to Launch

In 2023, a client approached me seeking to establish a U.S.-based company for online operations. He was located outside the United States, had no U.S. address or SSN. The goal — remote business management with a transparent tax structure and a U.S. bank account.

I joined the process at the stage where the client was independently researching options between LLC, S-Corp, and C-Corp, but was facing conflicting information. The task was not only to register the company, but also to build a clear structure for management and accounting.

What Steps Help Launch a Business?

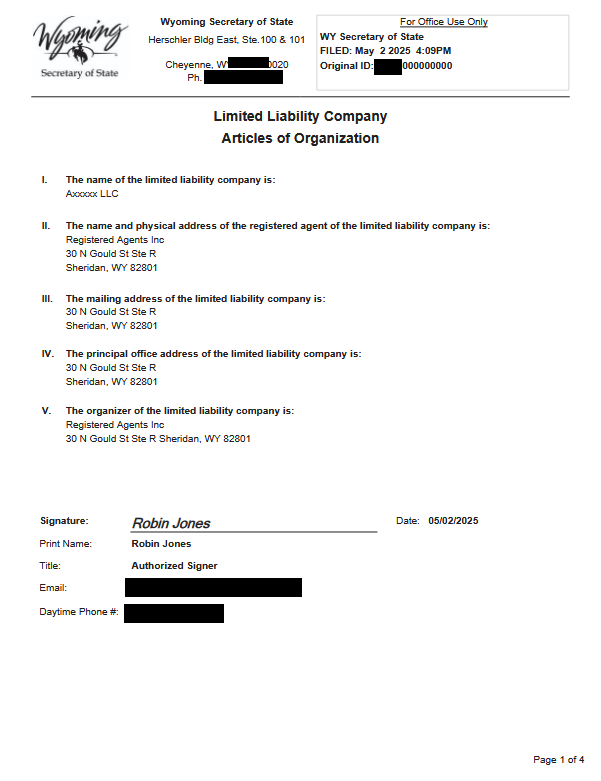

- Choosing the entity type and registration state. A comparative analysis of LLC, S-Corp, and C-Corp is conducted based on the client’s goals, citizenship, and business model. A state (e.g., Wyoming) is selected considering tax and administrative advantages for non-residents.

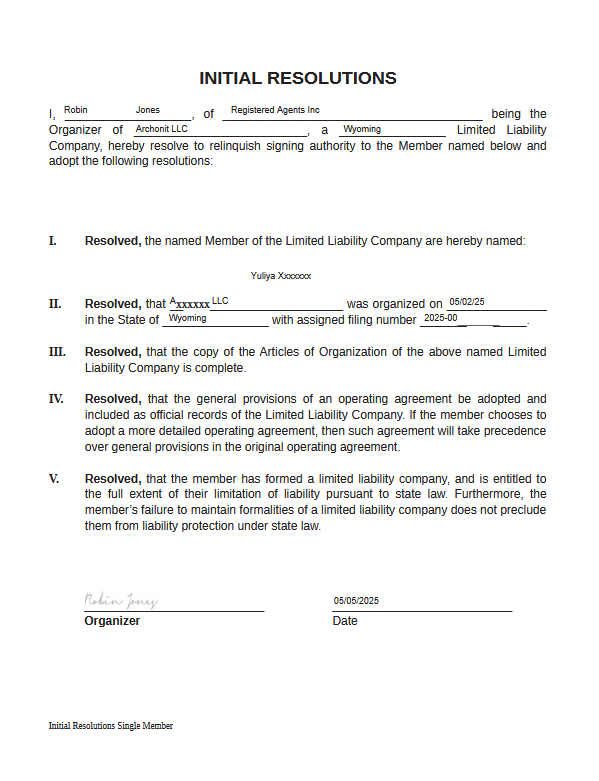

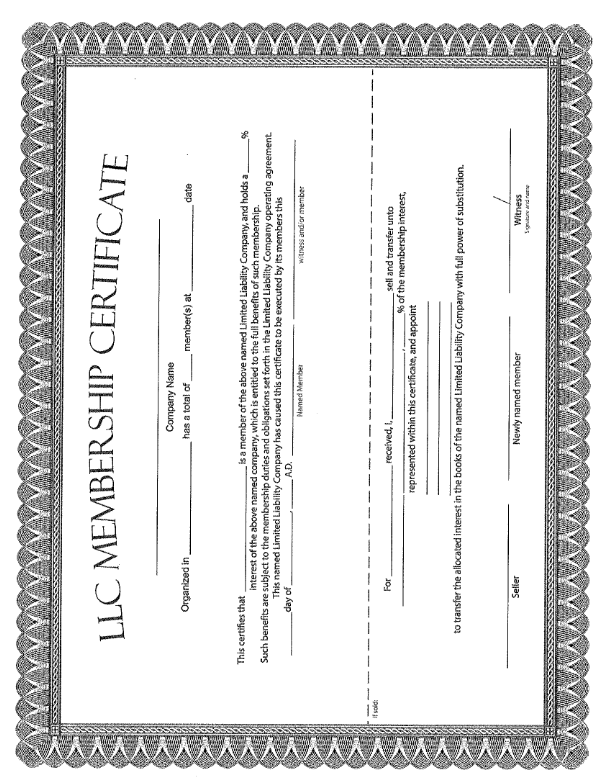

- Company registration and document preparation. Registration is arranged via a verified agent providing a U.S. address. Internal documents such as the Operating Agreement and Initial Resolutions are prepared with remote management in mind.

- Obtaining an EIN and opening a bank account. EIN is obtained directly from the IRS without an SSN. Banks allowing remote account opening are selected, with instructions provided for KYC and W-8BEN-E compliance.

- Basic tax navigation. Tax principles (e.g., pass-through entity for LLCs) are explained, along with mandatory reports (Form 5472, Annual Report) and reliable resources for bookkeeping support.

Case Study

Situation: A client from Europe planned to start a U.S. business without physical presence. The task included choosing the entity type, registering the company, and opening a bank account.

Actions taken:

- Analyzed LLC, S-Corp, and C-Corp options;

- Selected the optimal state and agent;

- Obtained EIN via IRS without SSN;

- Opened an account with an online bank (Mercury, Relay);

- Provided guidance on basic reporting and document flow.

Result: Within 3 weeks, the client received a registered company, EIN, and access to U.S. banking. The business started operating in compliance with legal requirements.

What Exactly Do I Offer?

- Personalized approach

I take into account your citizenship, goals, and business model. I explain complex things in simple terms. - Registration and documentation guidance

I provide templates and step-by-step instructions for registration, EIN application, and bank account setup. - Tax navigation support

I explain required reports, tax obligations, deadlines, and where to find help. - Verified resources

I recommend only trusted agents, banks, and accounting services tested in practice. - No pressure or hidden risks

I don’t “sell” registration — I provide legal support to help you avoid mistakes and unnecessary expenses.

Why Do Entrepreneurs Trust Me?

- Practical experience with non-resident business registration

- In-depth understanding of IRS tax requirements

- Ability to structure actions based on specific goals

- Knowledge of limitations and opportunities for remote business launches

If you're looking to start a U.S. business with minimal risk — contact me. I’ll help you choose the right entity, prepare documents, explain tax nuances, and provide support until you see results.

Registering a U.S. business is more than filling out a form. It’s a strategy. Timely, clear support helps you avoid mistakes, accelerate launch, and save resources. Acting wisely means acting confidently.