LLC vs Corporation — What’s Best for You?

When starting a business, one of the most important decisions you will face is choosing the appropriate legal structure. Two of the most common forms are Limited Liability Companies (LLCs) and Corporations. Each offers distinct advantages and disadvantages that can significantly affect your business operations, taxation, liability, and growth potential. At Legal Marketplace CONSULTANT, we aim to provide you with comprehensive insights to help you make an informed choice aligned with your business goals.

Understanding the Basics: LLC and Corporation

A Limited Liability Company (LLC) is a relatively flexible business entity blending certain characteristics of both partnerships and corporations. It provides its owners, known as members, with protection from personal liability for business debts, similar to a corporation. Meanwhile, a corporation is a more rigid and formal business structure recognized by state law as a separate legal entity owned by shareholders.

The fundamental distinction lies in ownership, management structure, taxation, and regulatory compliance, which can influence your choice between the two.

Ownership and Management Structure

LLCs offer remarkable flexibility regarding ownership and management. Members can consist of individuals, corporations, other LLCs, or foreign entities. There is no maximum number of members, and in many cases, an LLC can be a single-member entity. Management can be handled by members themselves or appointed managers, granting considerable operational adaptability.

On the other hand, corporations have a more formalized ownership and management structure. Ownership lies with shareholders, who elect a board of directors responsible for major decisions and appoint officers to manage daily operations. This structure is particularly favorable for businesses anticipating substantial external investment or public trading.

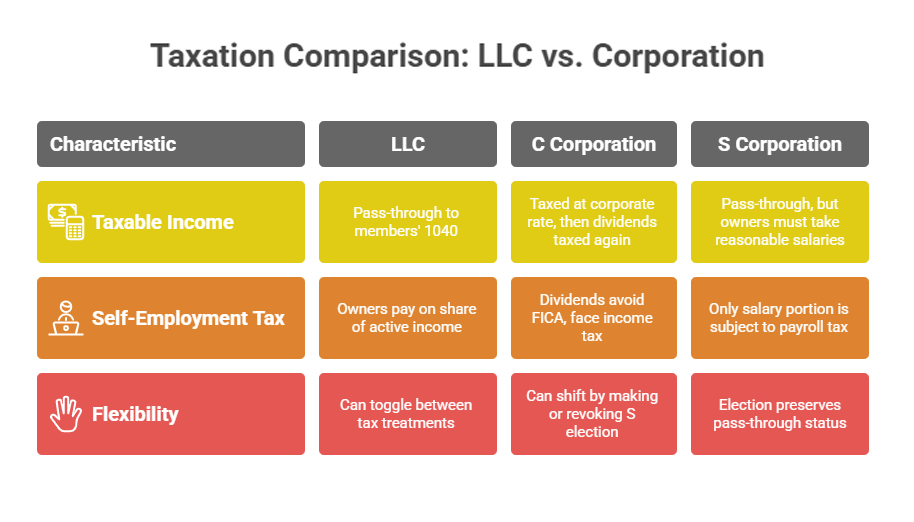

Taxation Considerations

One of the primary reasons entrepreneurs opt for an LLC is the simplicity and flexibility in taxation. By default, an LLC is treated as a pass-through entity for federal tax purposes, meaning profits and losses pass directly to members’ personal tax returns, avoiding the double taxation often associated with corporations.

However, LLCs can elect to be taxed as corporations if it benefits their financial strategy. This election allows for various tax planning opportunities, especially as the business grows.

Corporations are generally subject to corporate income tax at the federal and state levels. Traditional C corporations experience double taxation — once at the corporate level, and again when dividends are paid to shareholders. Alternatively, some corporations can elect S corporation status, allowing income to pass through to shareholders, thereby avoiding double taxation, but this option comes with eligibility restrictions and limits on the number and type of shareholders.

Liability Protection

Both LLCs and corporations provide limited liability protection, shielding personal assets from business debts and lawsuits. This means members or shareholders are generally not personally responsible for the company’s financial obligations.

However, maintaining this protection requires adherence to corporate formalities. Corporations must hold regular meetings, keep detailed records, and comply with various regulatory requirements. LLCs enjoy fewer formalities, which can make managing the company simpler while still preserving liability protection.

Raising Capital and Growth Opportunities

If your business vision involves raising substantial capital through public or private investors, forming a corporation is usually preferable. Corporations can issue various classes of stock, attracting venture capitalists and shareholders.

LLCs face limitations in raising capital, as membership interests are not as easily transferable and not publicly traded. Nevertheless, for small to medium-sized enterprises focused on operational flexibility and tax advantages, LLCs offer an excellent setup.

Regulatory and Compliance Requirements

Corporations are subject to stricter regulatory requirements, including mandatory board meetings, shareholder voting, annual reports, and extensive record-keeping. These formalities ensure accountability, especially important for public companies.

LLCs face fewer mandates, allowing business owners to focus more on operations without excessive administrative burdens. This factor often attracts startups and small businesses aiming for simplicity without sacrificing legal protections.

Profit Distribution

In LLCs, profit distribution can be highly flexible and does not need to correspond directly to ownership percentages. Members may agree on any allocation method that suits their preferences, documented in an operating agreement.

Corporations, conversely, distribute profits to shareholders through dividends based on the number of shares held. This structured approach suits companies with numerous investors by providing clarity and predictability.

Choosing Based on Your Growth Goals

The decision between forming an LLC or a corporation should be guided primarily by your long-term business objectives rather than market trends. If your focus is on simplicity, flexibility, and pass-through taxation, an LLC might be the best fit. Conversely, if you plan to seek venture capital, issue stock, or expand rapidly, a corporation may offer more suitable structural advantages.

It’s important to thoroughly evaluate your operational needs, ownership structure preferences, and financing strategies before finalizing your choice.

Legal Assistance and Professional Guidance

Navigating the complexities of business formation requires expert legal advice. At Legal Marketplace CONSULTANT, our seasoned attorneys specialize in guiding entrepreneurs through selecting and establishing the optimal business entity. We assist in drafting necessary documents, compliance procedures, and tax planning strategies to position your company for success.

Should you require detailed counsel tailored to your unique situation, do not hesitate to contact us. Reach out via communications provided in our bio or send a private message to schedule a consultation with our team.

- Comprehensive business entity selection advisory;

- Preparation and filing of formation documents;

- Customized operating agreements and corporate bylaws drafting;

- Ongoing compliance and governance support;

- Tax planning assistance and optimization strategies;

- Investor relations and capital raising guidance.

Summary: LLC vs Corporation in 2025

As of 2025, the landscape for forming LLCs and corporations remains consistent with the principles discussed throughout this article. An LLC continues to offer adaptability and straightforward taxation, while a corporation maintains its edge in credibility and attracting investors. Your decision should align with specific business goals, operational needs, and future ambitions rather than fleeting trends.

Both structures provide robust liability protection, but differ in management, compliance, and tax obligations. Understanding these distinctions empowers entrepreneurs to establish the right foundation for sustainable growth.

Legal Marketplace CONSULTANT is dedicated to supporting your business journey from inception to expansion. Whether you opt for an LLC or a corporation, our expertise ensures that your company is structurally sound, compliant with applicable laws, and positioned for success in today’s competitive market.

Choosing the correct legal entity is a pivotal step. We encourage you to seek professional guidance tailored to your unique needs. Contact us through the communication channels in our bio or send a private message to explore how we can assist you in making the best choice for your business future.

Legal Marketplace CONSULTANT — your trusted partner in comprehensive legal business services, dedicated to empowering entrepreneurs through expert advice and tailored solutions.