Investor-Ready Legal Setup for Startups

In the fast-paced world of startups, having a solid legal foundation is not just an option, but a necessity. Before you even think about pitching your innovative ideas to potential investors, it is crucial to ensure that your startup's legal structure is impeccably organized and transparent. Investors seek clarity and order within a company’s foundational documents and governance to mitigate risks and build trust. This article elaborates extensively on why an investor-ready legal setup is vital for startups and how you can achieve it effectively in 2025 and beyond.

Understanding the Importance of Legal Readiness Before Fundraising

The journey from a promising startup concept to securing real funding is often laden with legal hurdles. Many startups fail to attract serious investors simply because their corporate structure and legal documentation are unclear or incomplete. Legal readiness is synonymous with financial readiness in the eyes of investors; it provides a sense of security that their capital will be managed transparently and protected under well-defined agreements.

Investors do not invest in confusion or ambiguity. They invest in legally sound, well-governed entities where the distribution of ownership, intellectual property rights, and founder commitments are clearly demarcated. Startups that have an investor-ready legal setup can significantly speed up the due diligence process and increase their chances of closing funding rounds successfully.

Key Components of an Investor-Ready Legal Structure

Creating a legal framework that appeals to investors involves several crucial components. Each of these elements plays an integral role in ensuring transparency, protecting all parties involved, and facilitating future growth. The main components include:

- Cap Tables Management

- Founder Agreements and Roles

- Clear Intellectual Property (IP) Ownership

- Compliance with Corporate Formalities

- Preparation of Investment Documents

- Employment Contracts and Incentive Plans

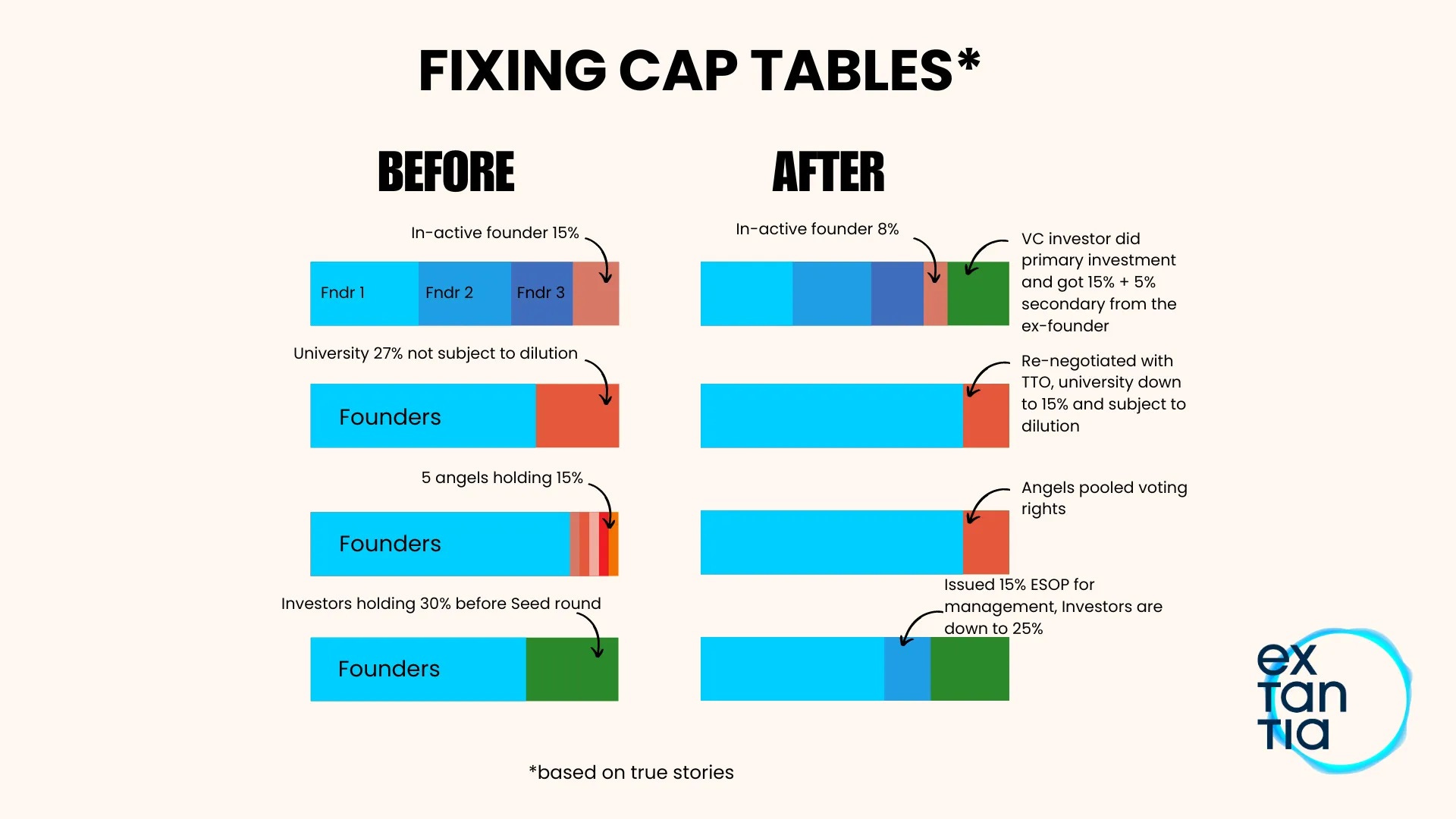

Cap Tables: The Cornerstone of Startup Equity Clarity

A capitalization table, commonly known as a cap table, is a detailed ledger that outlines the ownership stakes, equity dilution, and value in each round of funding. Investors examine the cap table meticulously to understand who owns what percentage of the company, the implications of convertible securities, stock options, and other forms of equity.

Startups must maintain up-to-date and accurate cap tables before initiating investor discussions. Common pitfalls include neglecting to record option pools correctly, failing to update after financing rounds, or overlooking warrants and convertible notes. In 2025, sophisticated software tools are available to help startups maintain their cap tables effectively, making it easier to provide clear, instantaneous ownership snapshots to potential investors.

Drafting Comprehensive Founder Agreements

Founder agreements are agreements between the founding members of the startup that define their roles, responsibilities, equity shares, vesting schedules, decision-making procedures, and the handling of disputes or exits. A well-written founder agreement effectively prevents ambiguities that could lead to conflicts down the line.

Investors look for clearly delineated founder roles to ensure the leadership team is stable and capable of executing the business plan. Vesting schedules are especially important to guarantee that founders remain committed for a certain period, with equity being earned over time rather than granted upfront. This aligns the interests of founders and investors toward long-term success.

Protecting Intellectual Property Ownership

Intellectual property (IP) is often one of the most valuable assets a startup owns. Whether it be proprietary technology, trademarks, patents, or copyrights, ensuring clear ownership and protection of IP rights is paramount. Before soliciting investments, startups must confirm that all IP created by founders, employees, or contractors is properly assigned to the company.

Ambiguities in IP ownership can create significant risks for investors, who may fear losing access to proprietary technology or face legal disputes against third parties. Startups should put in place comprehensive IP assignment agreements and confidentiality clauses to protect their innovations and maintain investor confidence.

Maintaining Corporate Formalities and Compliance

Proper compliance with corporate formalities is another essential aspect of an investor-ready startup. This includes holding regular board meetings, maintaining accurate corporate records, complying with local laws and regulations, and ensuring all filings are up to date.

Lapses in corporate governance might raise red flags for investors, as they reflect poorly on the management quality and increase legal risks. In 2025, startups must also ensure compliance with evolving regulations that may affect data protection, securities laws, and international operations.

Preparing Investment Documents

When approaching investors, startups should have all necessary investment documents prepared and organized. These include term sheets, stock purchase agreements, subscription agreements, and disclosure schedules. These documents clearly outline the terms of the investment, rights of investors, and obligations of the company.

Having professionally drafted and reviewed documents demonstrates professionalism and readiness, greatly enhancing investor trust. It also minimizes lengthy legal negotiations during funding rounds, allowing startups to close investments efficiently.

Employee Contracts and Equity Incentive Plans

Building and retaining a talented team is critical for startup success, and legal readiness encompasses managing employment relationships properly. Startups should have employment agreements that include non-compete, confidentiality, and IP assignment clauses.

Equity incentive plans such as stock options are widely used to align employee interests with company growth. Startups must design these plans thoughtfully, ensuring compliance with tax laws and securities regulations while providing attractive incentives that help attract top-tier talent.

Benefits of an Investor-Ready Legal Setup

- Accelerates the due diligence process by offering clear documentation and transparent ownership structures.

- Reduces legal risks and potential disputes among founders, employees, and investors.

- Enhances credibility and professionalism, fostering investor confidence.

- Facilitates smoother negotiations and quicker closing of funding rounds.

- Protects the startup’s valuable intellectual property and proprietary technology.

- Ensures compliance with legal and regulatory requirements, avoiding costly penalties.

How to Get Professional Legal Assistance

Navigating the complexities of legal setup for startups can be challenging without expert guidance. At Legal Marketplace CONSULTANT, we specialize in providing comprehensive legal services tailored to startups preparing to raise capital in 2025. Our team of experienced attorneys helps you structure your company, draft necessary agreements, manage IP rights, and prepare all essential investment documents.

We understand the dynamic startup environment and investors’ expectations, allowing us to deliver precise and pragmatic legal solutions that align with your business goals. Should you require proper legal help, please reach out through the communication channels specified in our bio or send a private message. We are here to help you present your startup as a trusted, orderly, and investment-ready business.

Common Mistakes to Avoid in Legal Structuring

Many startups make avoidable errors in their early legal structuring that can lead to delays or loss of investor interest. Some of the most frequent mistakes include:

- Failing to update the cap table after financing and equity grants.

- Ignoring vesting schedules causing founder disputes.

- Overlooking the assignment of IP developed by contractors.

- Neglecting to document key corporate resolutions and meetings.

- Using generic templates for investment agreements without legal customization.

- Underestimating compliance requirements for employment and tax laws.

The Strategic Role of Legal Setup in Startup Growth

A strong legal foundation not only facilitates funding but also supports sustainable growth. Well-defined ownership structures motivate founders and employees alike, fostering a culture of accountability and commitment. Clear IP rights offer competitive advantages and create exit opportunities through licensing or acquisition.

Additionally, legal compliance minimizes risks of fines and operational interruptions. From the perspective of potential partners, clients, and regulators, a startup with impeccable legal order reflects maturity and reliability, attributes that become more significant as the company scales.

Looking Ahead: Legal Trends Impacting Startups in 2025

As the legal landscape evolves, startups must stay abreast of emerging trends and regulatory changes. In 2025, notable shifts include increased scrutiny on data privacy laws, expanding regulations on digital securities offerings, and enhanced requirements for ESG (Environmental, Social, and Governance) disclosures.

Startups must proactively implement policies and legal strategies to comply with these changes to maintain investor and market confidence. Partnering with knowledgeable legal advisors will ensure your legal setup is adaptable and forward-looking.

Establishing an investor-ready legal setup is fundamental for any startup aspiring to attract serious funding and achieve long-term success. The clarity it brings to ownership, governance, and intellectual property can make the difference between a seamless investment process and lost opportunities.

Legal Marketplace CONSULTANT is dedicated to supporting startups through every stage of their legal preparation, providing tailored solutions that align with evolving market demands in 2025. Don’t leave your funding chances to chance — ensure your legal foundation is solid and investor-ready.

Legal Marketplace CONSULTANT — a specialized legal company committed to comprehensive legal support for startups and businesses. Our team includes experienced attorneys, legal consultants, and compliance experts focused on delivering practical and effective legal solutions for fundraising readiness and corporate governance.

Legal Marketplace CONSULTANT helps startups navigate complex investment negotiations and documentation with professionalism, ensuring quick and successful funding rounds in 2025 and beyond.

Legal Marketplace CONSULTANT offers specialized advice on intellectual property protection and assignment to safeguard your innovations and increase investor confidence.