Structuring Investments Through U.S. and Offshore Entities

Owning a business or property involves more than just possession—it significantly affects how you are taxed. Proper structuring of your investments using layered entities across jurisdictions is a strategic approach to reduce tax exposure, mitigate risks, and maintain strict compliance with the law. This article explores the essential aspects of investment structuring via U.S. and offshore entities, focusing on legal protections, tax efficiency, and operational flexibility that such arrangements can offer.

Understanding Investment Structuring

Investment structuring refers to how ownership rights and responsibilities are divided among legal entities that hold or control assets and businesses. It directly impacts tax liabilities, legal protections, and the overall management of assets. A well-planned structure can optimize these elements to safeguard investments and improve financial outcomes.

In particular, using a combination of U.S.-based corporations, limited liability companies (LLCs), and offshore entities allows investors to create a tailored architecture that aligns with their goals. These layered structures are often used to legally protect assets from potential claims, enhance privacy, and minimize tax burdens.

Why Use Layered Entities Across Jurisdictions?

Investors choose to deploy multiple entities across various jurisdictions for several critical reasons:

- Limiting legal exposure by isolating risks associated with different investments or operations.

- Taking advantage of favorable tax regimes to optimize tax efficiency.

- Maintaining confidentiality and privacy in ownership structures.

- Complying with both domestic and international regulations by structuring ownership transparently.

- Enhancing estate planning and ease of transferring ownership interests.

Each layer in the structure serves a purpose, whether it is to shield assets, facilitate operations, or secure tax benefits. Understanding the function and compliance requirements for each entity is vital for a successful outcome.

The Role of U.S. Entities in Investment Structuring

The United States offers a variety of entity types that investors utilize depending on their objectives. Common forms include corporations (C-corp and S-corp), limited liability companies (LLCs), and partnerships. Each entity type has distinct tax treatments, governance rules, and flexibility advantages.

LLCs, for example, are widely favored for their simplicity and pass-through taxation, which prevents double taxation on income. Corporations can be beneficial where investors seek to raise capital from multiple shareholders or prepare for public offerings. Moreover, U.S. entities provide robust legal protections and a transparent framework that promotes investor confidence.

By establishing a U.S. entity as part of a layered structure, investors benefit from access to the U.S. market, banking system, and legal system. It also facilitates compliance with U.S. tax reporting and regulatory requirements, which is crucial for maintaining legitimacy.

Utilizing Offshore Entities in Investment Structures

Offshore entities are companies or trusts established outside the investor's country of residence, often in jurisdictions known for favorable tax regimes, confidentiality, and ease of formation. Popular offshore jurisdictions include the Cayman Islands, British Virgin Islands, Bermuda, and Luxembourg, among others.

The primary advantages of incorporating offshore entities include:

- Access to low or zero corporate taxes.

- Increased privacy and asset protection.

- Simplified regulations concerning ownership and transfer of shares.

- Facilitation of international business operations and investments.

It is essential to maintain transparency and compliance with international tax laws such as the Foreign Account Tax Compliance Act (FATCA) and Common Reporting Standard (CRS). The goal is not to hide assets but to use structuring smartly and legally to protect wealth.

Key Considerations When Structuring Investments

When designing an investment structure through U.S. and offshore entities, several factors must be considered:

- Tax Implications: Understanding the tax consequences in both the home country and the jurisdictions where entities operate.

- Legal Compliance: Ensuring all entities comply with applicable laws and reporting requirements to avoid penalties.

- Asset Protection: Structuring to shield assets from creditor claims, lawsuits, or other liabilities.

- Operational Flexibility: Providing a framework that supports efficient management and business dealings.

- Cost and Complexity: Balancing the benefits of sophisticated structures against formation and maintenance expenses.

An expert advisory team composed of legal, tax, and financial professionals can guide investors through navigating these complex considerations effectively.

Common Structures Involving U.S. and Offshore Entities

Many investors use a combination of the following structures:

- A U.S. LLC owned by an offshore holding company, providing both limited liability and tax advantages.

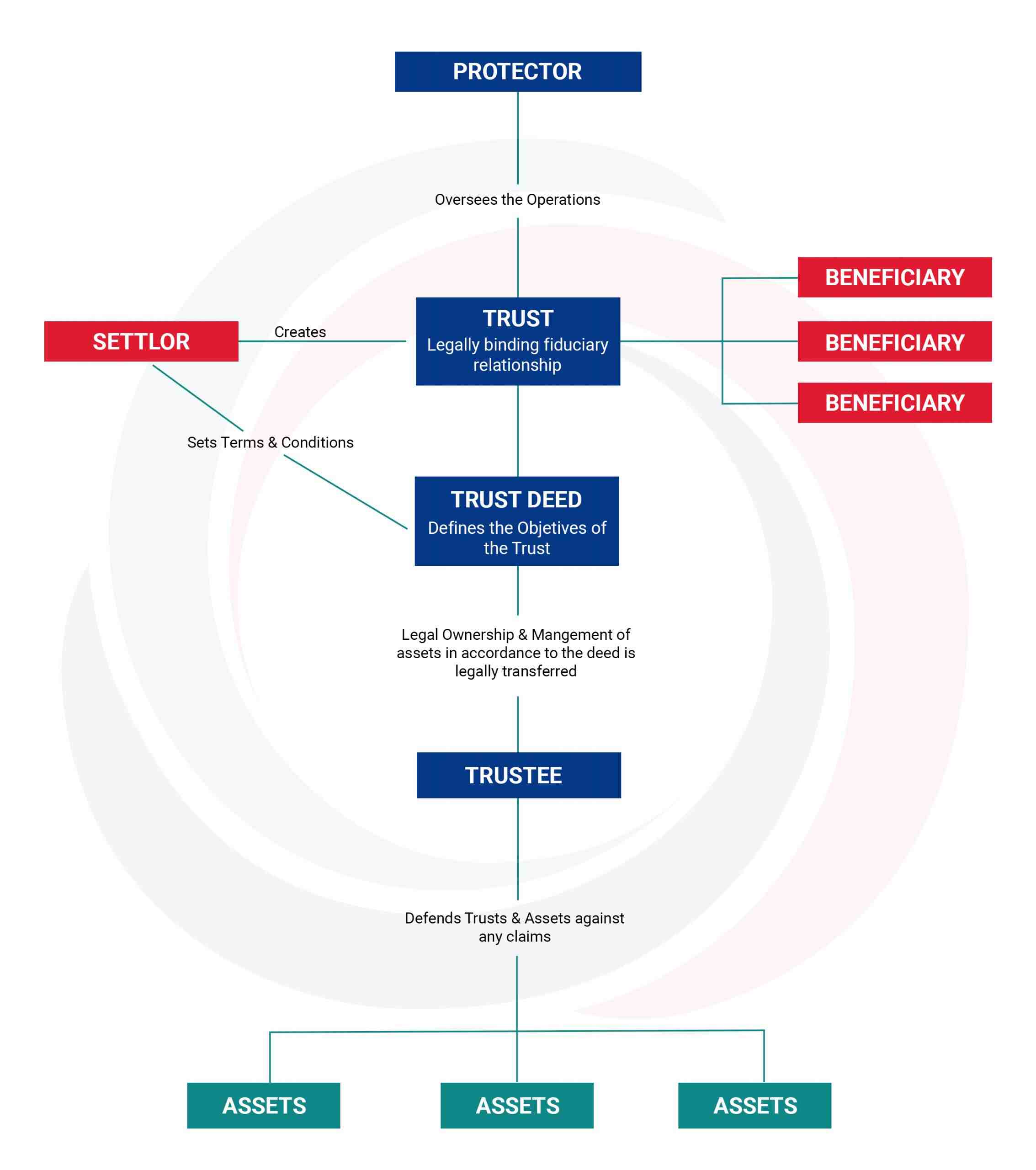

- A series of offshore trusts and companies that hold interests in U.S.-based businesses or properties.

- A Delaware corporation with offshore subsidiaries to separate operational and holding activities.

These arrangements can be tailored to the nature of the investments, jurisdictions involved, and investor preferences to maximize protection and efficiency.

Legal and Regulatory Compliance

Compliance is paramount when structuring investments through multiple entities. Investors must adhere to reporting requirements such as:

- U.S. Internal Revenue Service (IRS) filings including Form 5471, 8865, and FBAR reports for foreign entities and accounts.

- Regulations enforced by the Financial Crimes Enforcement Network (FinCEN) to prevent money laundering.

- International tax transparency standards such as CRS.

Failing to comply with these regulations may result in severe penalties, criminal charges, or loss of legal benefits associated with the investment structure. Hence, engaging knowledgeable consultants is crucial.

Myths About Investment Structuring

There are common misconceptions that structuring through U.S. and offshore entities is primarily for tax evasion or hiding assets. In reality, the purpose is to protect assets legally and optimize tax obligations within the law. Transparency and compliance are the foundation of a successful and ethical investment structure.

It is also mistaken to believe that offshore entities are exclusively for wealthy individuals. Entrepreneurs of various sizes use these tools to scale, protect, and organize their businesses properly.

Steps to Establish a Layered Investment Structure

- Define your investment goals and risk tolerance.

- Consult qualified legal and tax professionals to design the optimal structure.

- Select jurisdictions that provide the appropriate legal frameworks and tax advantages.

- Form U.S. and offshore entities according to legal requirements.

- Set up proper corporate governance, accounting, and compliance procedures.

- Continually review and adjust the structure to comply with evolving laws and financial objectives.

The Importance of Professional Legal Advice

The complexity and risks involved in structuring investments across borders require dedicated expertise. Professional legal assistance ensures that:

- Entities are established correctly with respect to formation documentation and operational requirements.

- Tax planning complies with both U.S. and international tax laws.

- All reporting and disclosure requirements are met to avoid regulatory issues.

- Asset protection strategies are effective and enforceable in relevant jurisdictions.

Legal professionals also help in negotiating complex agreements, resolving disputes, and facilitating smooth ownership transitions.

Trends and Changes Expected in 2025

In 2025, investment structuring is expected to see increased scrutiny from global tax authorities and regulators. Initiatives to combat tax avoidance, such as the OECD’s Pillar Two rules, will influence how entities are structured internationally.

Moreover, digital asset investments and evolving e-commerce platforms create new opportunities and challenges in investment structuring. Transparency and compliance will remain top priorities to avoid sanctions and reputational damage.

Conclusion

Structuring investments through U.S. and offshore entities offers strategic advantages in protecting assets, optimizing taxation, and enhancing operational efficiency. When done lawfully and transparently, layering entities across jurisdictions supports robust investment portfolios and business ventures.

Given the complexity of international laws and tax regimes, investors should seek professional advice to design and maintain compliant, effective structures. Legal guidance ensures peace of mind, allowing you to focus on growing and securing your wealth with confidence.

Legal Marketplace CONSULTANT — providing expert legal services in international investment structuring, tax planning, and compliance. Our team specializes in comprehensive support for business owners and investors looking to protect and grow their assets efficiently and lawfully.