Forming an LLC in the U.S.: A Comprehensive Guide

Forming a Limited Liability Company (LLC) in the United States is a strategic decision for entrepreneurs seeking flexibility, legal protection, and operational efficiency. An LLC combines the liability protection of a corporation with the tax advantages and simplicity of a partnership or sole proprietorship. In this detailed guide, Legal Marketplace CONSULTANT provides essential steps, insights, and best practices for successfully establishing your LLC while ensuring compliance with federal and state regulations.

Choosing the Right State for Your LLC

One of the fundamental choices you must make when forming an LLC is selecting the state in which to register your company. This decision impacts your legal obligations, taxes, and overall business environment. While it may be tempting to select states like Delaware or Nevada due to their business-friendly laws, it is crucial to consider where your business will primarily operate. Registering your LLC in your home state is generally advisable unless you have a specific strategic reason to incorporate elsewhere.

Key factors to evaluate when choosing a state include:

- State filing fees and annual report costs;

- Tax requirements and rates, including franchise and income taxes;

- Privacy protections for LLC members;

- Ease and speed of formation;

- Availability of strong legal protections and favorable court systems;

- Ongoing compliance demands and complexity.

Understanding these considerations can save you time and money and optimize the advantages your LLC receives under state law.

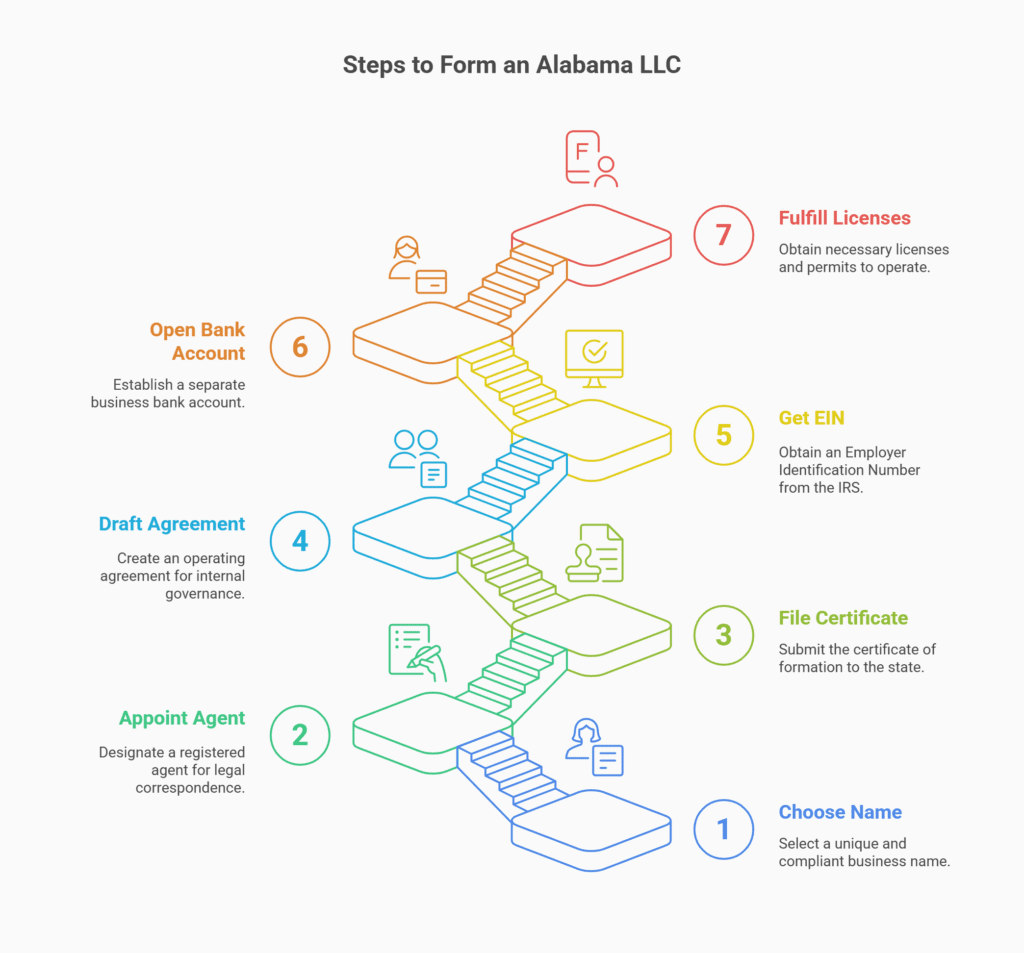

Filing Articles of Organization

Once you have selected the appropriate state for your LLC, the next step is to file the Articles of Organization (sometimes called Certificate of Formation or Certificate of Organization) with the state’s Secretary of State or relevant business filing agency. This document officially creates your LLC and includes essential information about your business.

Typical information required in the Articles of Organization includes:

- The LLC’s legal name, which must comply with state naming rules;

- The business purpose or nature of the LLC;

- The address of the principal office;

- The names and addresses of registered agents who can receive legal documents on behalf of the LLC;

- Duration of the LLC if not perpetual;

- Whether the LLC is member-managed or manager-managed.

Filing fees vary by state but typically range between $50 and $500. Many states offer online filing to expedite the process. Upon approval, you will receive a certificate or confirmation that officially recognizes your LLC.

Obtaining an EIN from the IRS

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is issued by the Internal Revenue Service (IRS) and serves as your LLC's unique identifier for tax and administrative purposes. Obtaining an EIN is mandatory if your LLC has employees, operates as a multi-member LLC, or elects to be taxed as a corporation.

Applying for an EIN is a straightforward process that can be completed online, by mail, or by fax. The online application on the IRS website is the fastest, often providing the EIN immediately upon completion. Your EIN enables you to open business bank accounts, file tax returns, and hire employees.

Drafting an Operating Agreement

Though not always legally required, drafting an operating agreement is a critical step for any LLC, whether single-member or multi-member. The operating agreement outlines the ownership structure, member roles, management, voting rights, profit distribution, and procedures for resolving disputes or handling changes such as adding or removing members.

Benefits of having a well-crafted operating agreement include:

- Clearly defining management roles and responsibilities;

- Preventing misunderstandings and conflicts among members;

- Establishing procedures for decision-making and operational governance;

- Protecting your LLC’s limited liability status by documenting separation from personal affairs;

- Providing a professional appearance to banks, investors, and partners.

Even if you are the sole owner of the LLC, an operating agreement is recommended to solidify the legal separation between you as an individual and the LLC entity.

Maintaining Separation of Finances

One of the fundamental advantages of an LLC is the liability shield it provides, protecting your personal assets from business liabilities. However, preserving this protection requires strict separation of business and personal finances.

Practical steps to maintain this separation include:

- Open a dedicated business bank account for your LLC;

- Use separate credit cards and financial tools for business expenses;

- Keep precise records and bookkeeping for your business transactions;

- Avoid mixing personal funds with business funds;

- Properly document any loans or capital contributions you make to the LLC.

Failure to keep business and personal finances distinct may result in courts "piercing the corporate veil," subjecting your personal assets to business debts or legal claims.

Additional Considerations for LLC Formation

Forming an LLC involves numerous additional steps and ongoing requirements, including:

- Compliance with local business licenses and permits regulations;

- Filing annual reports or statements as required by your state;

- Understanding federal, state, and local tax obligations;

- Securing appropriate business insurance (e.g., general liability, professional liability);

- Keeping records of minutes and resolutions for significant LLC decisions;

- Planning succession and buyout arrangements through your operating agreement;

- Seeking expert advice to tailor your LLC structure to your specific business needs and goals.

Consulting with legal and financial professionals ensures that your LLC formation aligns with best practices and laws effective as of 2025.

When to Seek Legal Assistance

Although forming an LLC might appear straightforward, complex situations, such as multi-state operations, multiple members, special licensing requirements, or tax elections, warrant professional guidance. Engaging experienced legal counsel can:

- Help customize your operating agreement and formation documents;

- Advise on tax planning and regulatory compliance;

- Assist with dispute resolution and risk management;

- Ensure ongoing compliance and avoid costly mistakes.

For consultation or legal support, contact us through the communication channels listed in our bio or send a private message for personalized assistance.

Legal Marketplace CONSULTANT is a premier legal services provider specializing in comprehensive business and individual legal support. Our team comprises seasoned attorneys, legal consultants, tax advisors, auditors, and accountants dedicated to helping you navigate complex legal landscapes with confidence and precision.

Forming an LLC in the U.S. is a powerful way to achieve business flexibility and protection. By carefully choosing the state of formation, filing the necessary organizational documents, obtaining an EIN, drafting a clear operating agreement, and maintaining proper financial separation, you establish a strong foundation for your business success.

Remember, compliance is key to preserving your LLC's limited liability shield and enhancing its credibility. Do not hesitate to consult with legal professionals to tailor the LLC formation process to your unique needs. Legal Marketplace CONSULTANT stands ready to assist you every step of the way, ensuring your LLC is structured and operated for optimal growth and protection effective as of 2025.