Choosing Between LLC and Corporation: A Comprehensive Guide

When starting a business, one of the most critical decisions you must make is choosing the right legal structure for your company. The two most popular entity types, especially in the United States, are the Limited Liability Company (LLC) and the Corporation. Each has its unique benefits, drawbacks, and implications for taxes, investor interest, and personal protection.

This article delves deep into the considerations involved in choosing between an LLC and a Corporation, helping entrepreneurs and business owners make informed decisions based on their goals and circumstances.

Understanding LLCs and Corporations

A Limited Liability Company (LLC) is a versatile business structure that offers its owners limited liability protection while allowing operational flexibility. It is a hybrid entity combining elements of both partnerships and corporations, providing a balance between protection and simplicity.

A Corporation, on the other hand, is a more formal business entity recognized as a separate legal entity from its owners. It typically attracts investors through the issuance of stock and requires adherence to rigorous compliance standards.

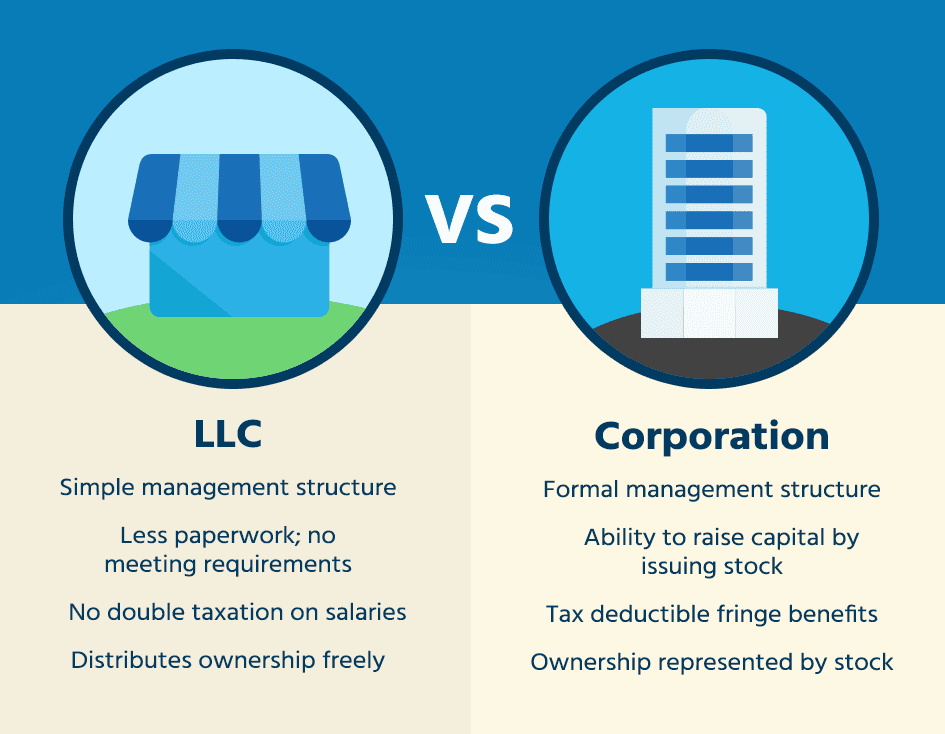

Key Differences Between LLC and Corporation

Understanding the fundamental differences between LLCs and Corporations is crucial before making a selection. These differences influence taxation, management, ownership, and compliance.

- Taxation: LLCs usually enjoy pass-through taxation, meaning income is taxed only once at the owner level. Corporations, particularly C-Corporations, face double taxation where income is taxed at the company level and dividends taxed again at the shareholder level.

- Ownership Structure: Corporations can issue shares, making it easier to attract investors, while LLCs have members and generally do not issue stock.

- Compliance and Formalities: Corporations must follow strict corporate formalities including holding regular board and shareholder meetings, maintaining minutes, and filing annual reports. LLCs have fewer formalities and more operational flexibility.

- Management: LLCs are typically managed directly by members or by appointed managers. Corporations have a structured hierarchy with directors, officers, and shareholders.

- Personal Liability Protection: Both LLCs and Corporations provide limited liability protection, but the strength of this protection can differ based on how the entity is managed and legal precedents.

Tax Implications

One of the most significant considerations when choosing between an LLC and a Corporation is taxation. The choice affects how your income is taxed and can have long-term impacts on your company’s profitability and cash flow.

Most LLCs operate under pass-through taxation, which means the company itself is not taxed. Instead, profits and losses pass through to individual members' tax returns, potentially avoiding the double taxation commonly associated with Corporations.

Corporations, especially C-Corporations, are subject to corporate income tax. After paying taxes on profits, dividends distributed to shareholders are taxed again at the individual level. However, S-Corporation status allows for pass-through taxation but comes with strict eligibility requirements.

Investor Attraction and Funding

Corporations are generally more attractive to investors because they can issue shares and have a more familiar structure for venture capitalists and public markets. A corporation's ability to raise funds through stock sales makes it the preferable option for businesses seeking substantial external funding.

Conversely, LLCs tend to be less appealing to investors who may prefer the clear stock-based ownership and governance offered by corporations. This distinction often influences startups and fast-growing companies in their choice of entity.

Flexibility and Management Control

LLCs offer considerable flexibility in management and operations. Members can decide how to manage their company, distribute profits, and handle internal affairs without the burden of corporate formalities.

Corporations operate under a fixed hierarchical structure with prescribed roles such as directors and officers. While this structure supports governance and accountability, it requires adherence to specific regulations and formalities that can be cumbersome for smaller businesses.

Personal Liability Protection

Both LLCs and Corporations provide a shield against personal liability in most cases, meaning owners’ personal assets are protected from business debts and legal claims. However, this protection is not absolute and depends on proper business practices and compliance with legal requirements.

Maintaining clear separation between personal and business activities is vital to preserving limited liability protection, regardless of entity type.

Compliance Requirements and Administrative Burden

Corporations have ongoing compliance requirements such as holding annual shareholder meetings, maintaining detailed minutes, and filing specific reports with state authorities. These requirements can increase administrative burden and cost.

LLCs typically face fewer and less stringent compliance obligations, making them easier and less costly to maintain, especially for small and medium-sized businesses.

Residency Status and its Influence on Entity Choice

Your residency status can affect your choice of entity due to tax implications, legal requirements, and access to benefits. Non-resident business owners might face restrictions or additional reporting requirements when choosing between an LLC or Corporation.

International entrepreneurs should carefully assess how each entity type aligns with their residency and business strategy.

When to Choose an LLC

- If you prioritize operational flexibility and simple management.

- If you want to avoid double taxation with pass-through tax treatment.

- If you are a small business owner or freelancer.

- If compliance cost and administrative burden are a concern.

When to Choose a Corporation

- If you aim to raise capital from investors or go public.

- If you want to issue shares and stock options to employees and investors.

- If you are prepared to comply with corporate formalities and regulations.

- If you want to establish a structured management hierarchy.

Legal Assistance and Next Steps

Choosing the right business structure can be complex and legally significant. It is advisable to consult with legal experts to understand the nuances related to your specific situation, including state laws and long-term objectives.

At Legal Marketplace CONSULTANT, we offer specialized guidance to help you determine the best entity based on your goals, residency status, and operational needs. Reach out via the communications in our bio or send a private message to schedule a consultation.

Choosing between an LLC and a Corporation is a foundational decision that influences many aspects of your business, including taxation, liability, investor appeal, and administrative responsibilities. Both entity types offer unique advantages, and the best choice depends on your specific business goals and circumstances.

By understanding the differences and seeking proper legal guidance, you can set your business on a path toward success with the right structure supporting your aspirations.

Legal Marketplace CONSULTANT is a legal company specializing in comprehensive legal services for businesses and individuals. Our team includes attorneys, legal consultants, tax advisors, auditors, and accountants dedicated to supporting your business at every step.