Choosing the Right State to Incorporate: Delaware, Florida, or California?

Incorporating a business is a crucial step for entrepreneurs and companies aiming to establish a legal presence in the United States. Selecting the appropriate state of incorporation is not just a matter of preference but a strategic decision that impacts taxes, filing costs, privacy regulations, investor appeal, profits, and compliance obligations. This in-depth guide explores the advantages and disadvantages of incorporating in Delaware, Florida, and California, to help you make an informed choice that aligns with your business goals.

Why the Choice of State Matters

The state in which you incorporate your business determines the legal framework governing your operation, including corporate governance, tax liabilities, reporting requirements, and protections offered to business owners and investors. Each state administers its own set of laws and fees that affect your ongoing expenses and the complexity of managing your business from a legal standpoint. Therefore, choosing the right state is not merely an emotional decision but a calculated strategy that can positively or negatively impact your company's finances and growth potential.

Delaware: The Corporate Haven

Delaware is widely regarded as the most business-friendly state for incorporation due to its advanced and flexible corporate laws, efficient judiciary system, and favorable tax structure. It is the incorporation state of choice for over 1 million businesses, including many Fortune 500 companies.

One of the main distinctions of Delaware is its Court of Chancery, a specialized business court known for resolving corporate disputes expeditiously and expertly without juries. This court’s rulings set significant precedents, offering predictability and clarity to corporate governance issues.

From a tax perspective, Delaware does not impose corporate income tax on companies that do not conduct business within the state. However, there are franchise taxes that corporations must pay, which vary based on the number of shares authorized or the assumed par value capital. While these taxes can be higher compared to some other states, the benefits of Delaware’s legal framework often outweigh the costs for many businesses.

Additionally, Delaware offers strong privacy protections, as it does not require disclosure of officer or director names in the public records, providing an additional layer of confidentiality for company owners.

Florida: Attractive for Small Businesses and Startups

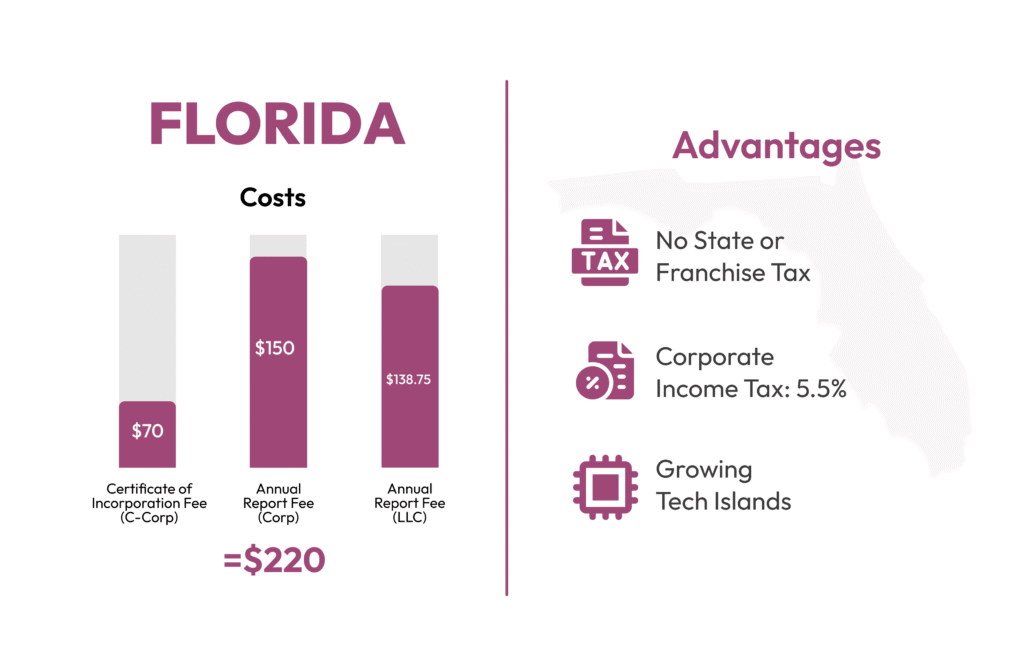

Florida is known for its business-friendly climate, with no personal income tax and relatively low filing fees. It appeals especially to startups, small businesses, and enterprises focused on local or regional markets.

The state's taxation system offers considerable advantages. For instance, while Florida has a corporate income tax, it stands relatively low at a flat rate of 5.5% as of 2025, potentially benefiting businesses with high net income but fewer distribution requirements. Moreover, Florida’s lack of a personal income tax can be advantageous for sole proprietors and pass-through entities whose profits are reported on individual tax returns.

In terms of privacy, Florida requires more disclosure than Delaware but provides reasonable protections for owners’ information. The state’s affordable filing fees and ease of maintenance make it a popular choice for entrepreneurs seeking to balance cost efficiency with favorable tax conditions and business resources.

California: A Hub for Innovation with Higher Costs

California is home to a vast and diverse economy and is recognized as a global technology and innovation hub. Incorporating in California is ideal for businesses planning to operate primarily within its borders or seeking to access the state's significant investment networks and talent pools.

However, California is known for its higher taxes and stricter regulatory environment. Corporate income tax rates can be as high as 8.84%, plus an annual minimum franchise tax of $800, which applies even to companies without profit. These factors contribute to higher ongoing costs for businesses compared to Delaware or Florida.

Moreover, California laws are often more stringent in terms of employment, environmental compliance, and consumer protections, which increases operational complexity. On the privacy front, California has enacted robust regulations like the California Consumer Privacy Act (CCPA), which affects business practices regarding consumer data handling.

Comparing Key Factors of Incorporation

- Taxation: Delaware offers no corporate income tax on out-of-state activities but charges franchise taxes; Florida features no personal income tax and a low corporate tax rate; California imposes higher corporate taxes and franchise fees.

- Filing Costs and Fees: Delaware’s initial filing fees are moderate, with franchise taxes varying; Florida has low filing fees and maintenance costs; California has higher filing and annual fees.

- Legal Environment: Delaware’s Court of Chancery provides expert corporate dispute resolution; Florida has a standard state court system; California has complex regulations affecting various business aspects.

- Privacy: Delaware offers strong confidentiality for owners; Florida mandates some disclosures; California enforces strict consumer privacy laws.

- Investor Appeal: Delaware is often preferred by investors due to its predictable legal system; Florida and California have growing markets but may present more regulatory risks.

- Compliance Complexity: Delaware incorporates simplicity for many corporate formalities; Florida offers relatively straightforward compliance; California requires more rigorous reporting and regulatory adherence.

Factors to Consider Before Making a Choice

- The primary location of your business operations and customers.

- The corporate structure you plan to adopt (LLC, C-Corp, S-Corp).

- The nature and extent of investor involvement and requirements.

- Your business growth strategy, including potential expansion plans.

- The importance of privacy and confidentiality to your owners and managers.

- Your budget for incorporation and ongoing compliance costs.

- The legal and tax advice available to you through professionals.

Each of these factors can greatly influence the benefits or drawbacks of incorporating in a specific state. Thoughtful analysis and strategic planning will enable you to maximize advantages while minimizing risks and expenses.

How to Navigate Incorporation Successfully

To ensure the best outcome, it is highly recommended to consult with legal and financial experts who specialize in corporate law and tax strategy. They can provide personalized advice tailored to your business model and goals. Utilizing professional services can help avoid costly mistakes, maintain compliance, and optimize your organizational structure.

Moreover, reviewing current state laws and keeping abreast of changes effective in 2025 and beyond will allow your business to adapt quickly to new regulations and opportunities.

Final Recommendations

If your business model prioritizes investor relations and benefits from a predictable legal environment, Delaware may be the most suitable choice. For cost-effective incorporation with favorable tax treatment primarily focused on smaller-scale businesses or regional activities, Florida stands out. For companies deeply engaged in California's market or seeking to leverage its innovation ecosystem despite higher costs, incorporating locally is logical.

Ultimately, the decision should balance a thorough understanding of your business needs, growth plans, and compliance capacities with the unique attributes of each state’s incorporation framework.

Choosing strategically rather than emotionally is essential to lay a foundation for sustainable success. When in doubt, reaching out to qualified professionals ensures you receive proper guidance tailored specifically for your situation.

Incorporating your business is a fundamental decision that influences numerous operational, financial, and legal aspects. Delaware, Florida, and California each present distinct advantages and challenges related to taxes, fees, privacy, legal environments, and investor relations. Understanding these factors thoroughly will empower you to select the state that best aligns with your business objectives.

Strategic incorporation lays the groundwork for attracting investors, optimizing profits, and maintaining compliance efficiently. We recommend consulting with experienced legal and tax advisors who can tailor recommendations to your unique business needs and ensure a smooth incorporation process. Should you require professional assistance, please feel free to contact us through the communication channels available in our bio or send a private message. The right guidance can make all the difference between a successful incorporation and avoidable obstacles.

Legal Marketplace CONSULTANT is a specialized legal company focused on comprehensive legal support for businesses and individuals. Our professional team includes attorneys, legal consultants, tax advisors, auditors, and accountants dedicated to delivering expert services tailored to your needs.